Published on

Tuesday, December 17 2019

Authors :

Eamon Cullinane

We’ve written a lot about the market implications of the International Maritime Organization (IMO) regulations to reduce the sulfur level in bunker fuel. These new specifications, which come into full force on a global basis on January 1, present both opportunities and challenges for refiners, depending on their existing processing capabilities. Refiners in the U.S., by and large, will see major benefits from deeper discounts for heavy sour crude and residual feedstocks, due to their superior deep conversion configurations and limited yields of high sulfur fuel oil. By contrast, our neighbors to the south, from Mexico, on down to South America, will face significant challenges, considering most of the refineries in the region are much less complex and produce significantly higher volumes of high sulfur residual products. In fact, the average fuel oil yield for the 67 refineries throughout Latin America is almost eight times higher than that for U.S. Gulf Coast (USGC) refineries (16% vs. 2%), with yields well above 20% prevailing in some of the larger refining industries in the region, notably Mexico and Venezuela, where local refineries are burdening with running local heavy sour crudes despite a lack of operable upgrading capacity. In today’s blog, we will outline the IMO 2020 issues faced by Latin American refiners and discuss the options available to them in meeting those challenges.

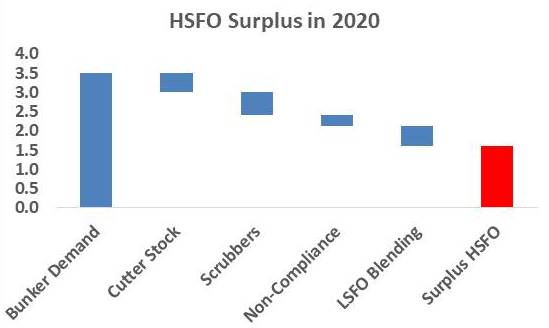

In the past, a majority of the high sulfur fuel oil produced by refiners has made its way into the bunker market. The bunker fuel proportion has in fact been growing as demand in the power generation market has declined due to environmental regulation restricting sulfur levels in regions around the world. In just a couple of weeks, this same regulatory impact will hit the bunker market all at once as IMO 2020 will require ships around the world to either switch from burning fuel oil with a 3.5% S limit to a 0.5% S limit or install scrubbers. With scrubber installation on ships lagging, and likely to account for only about 10% of effective capacity in 2020, there will be a significant surplus of high sulfur resid and a corresponding bump in demand for compliant replacements, primarily distillate.

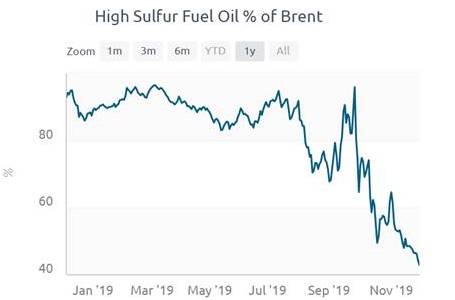

The surplus in high sulfur fuel oil will result in much lower prices for this product, which in fact has already taken place as the industry gears up for January 1, with relative fuel oil prices falling by double digit dollars per barrel over the past couple of months. This is certainly bad news for Latin American refiners who produce high levels of this discounted fuel, but they do have a variety of options to respond to the changing market conditions, which are outlined below.

Option 1: Upgrade HSFO into other Products

Brazil has over 15 refineries and claims the most processing capacity out of any country in Latin America at 2.2 million bpd, with Mexico and Venezuela following at 1.6 million and 1.3 million bpd, respectively.

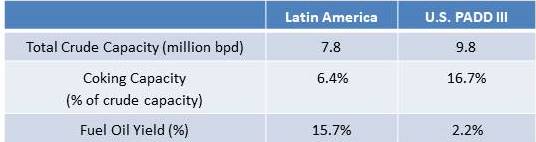

However, in terms of coking capability, Latin America is severely lacking.

Latin America coking capacity as a percent of crude capacity stands at ~6.5% while PADD III of the U.S. has a capacity of ~17%. Another obvious indicator would be fuel oil yield. Latin America has a ~16% fuel oil yield while the USGC closing in on 2%.

Latin America has, in large, wanted to modernize its refineries, but its inability to execute projects, inefficient state-owned operations, economic and political instability, and lack of skilled workforce has prevented this from materializing.

Option 2: Sell to Refineries with Excess Upgrading Capacity

U.S. Coking has been unloaded due to a loss of heavy crude globally. This spare capacity will be allow imports of fuel from the likes of Latin America. In particular, Mexico’s fuel oil yields are ~25% and have historically exported excess fuel oil; however, as the price of high sulfur fuel oil goes down, complex USGC refineries will reap the cheap feedstock, while Mexico’s margins will struggle.

Option 3: Lighten/Sweeten Crude Slate

Refineries in Brazil and Argentina have a few options (Ostra, Escalante, etc.) to load up on sweet crudes to make compliant fuel oil. On paper, the idea of going to a light/sweet slate may seem promising, but there are a few issues. If your slate gets too light, you will run into overhead limits and may have to reduce runs. Another issue is simply supply. There are only so much of these crudes to go around and with demand increasing; it will become a very pricy option even if you are able to procure a slate light/sweet enough.

Option 4: Power Generation & Asphalt

A majority of the global power generation has already switched to gas-fired boilers for both economics and environment. Liquid fuel oil power generation for a majority of countries is no longer an option. Not only do they not have the dual capability boilers, but most countries at this point have implemented laws to restrict the burning of high sulfur fuel oil. That being said, if the price of fuel oil goes down enough, it could very well complete with the likes of gas in the power generation market; however, investments in appropriate utility capability would require a large investment for a majority of countries.

The main issue with the asphalt market is that it is already well supplied. Asphalt prices could be depressed overall as HS resid looks for alternate homes, but there will be significant market differentiation as higher quality asphalts should increase in price as significant lower quality material makes its way into the market. A majority of Mexico’s and Brazil’s refineries already participate in the asphalt market.

Option 5: Blend down with distillate or LSVGO

Some refiners may turn to blending low sulfur distillate streams into the fuel oil to produce compliant fuel. LS vacuum gas oil will be diverted to the bunker market and this will increase both its price and lead to lower FCC rates, impacting gasoline supply and increasing prices. The value of low sulfur FCC slurry will also rise as it will be diverted to LS bunker blending. Asphalt prices could be depressed overall as HS resid looks for alternate homes, but there will be significant market differentiation as higher quality asphalts should increase in price as significant lower quality material makes its way into the market.

Option 5: Storage of HSFO

This would be a short-term option only as most refiners have between 10-30 days’ worth of HSFO storage. Any additional floating storage would cost an arm and a leg. Lastly, compounding this issue is lack of high sulfur storage tanks across the blenders/bunker ports that have already switched over to LSFO for IMO 2020.

Option 6: Reduce Runs/Shutdown

Refiners unable to upgrade or find a home for HSFO could potentially reduce runs or even shutdown early next year.

Option 7: Do Nothing

This option may very well lead to option 6.

Closing thoughts:

The transition in the near term will bring both uncertainty and volatility to the markets. Latin America Refiners will be particularly challenged with less coking capability and regionally a heavy-sour crude slate. The market is already adjusting for the surplus of HSFO, and putting downward pressure on the price. This can be seen in the graph below.

Source: IMO 2020 Tracker Tool

Lastly, here is a look at the make-up of bunker sales at the Singapore port.

LSFO sales represented 40% of the bunker market last month as opposed to 1.2% of the market last November.

As the markets continue to evolve you can use the Turner Mason & Company IMO 2020 Tracker Tool, an online interactive dashboard highlighting relevant crude and product differentials, crack spreads and refining margins across the USGC, Northwest Europe and Singapore. The Tracker also captures distillate and fuel oil stocks, fuel oil imports, and bunker sales. It provides daily updates on price movements of relevant crudes, refined products and refining margins. Along with the 20+ interactive charts, each week, we will provide market updates, commentary and highlight specific graphs that we believe to be most relevant. Commentary coverage ranges from price spreads, fuel oil supply and storage, scrubber installations and overall IMO compliance levels.

TM&C also develops and publishes a comprehensive analysis of all aspects of global petroleum markets, the Crude and Refined Products Outlook (C&RPO). This publication is issued on a semiannual basis, with the next edition, the 2020 C&RPO, due out in February 2020. If you have any questions about the IMO 2020 Tracker Tool, the C&RPO or on any of our other analyses or our consulting capabilities, please send an email to us or give us a call at 214-754-0898.