Published on

Thursday, July 8 2021

Authors :

Philip Guillemette

On May 25, 2021, legislation was introduced both in the U.S. House of Representatives and Senate to extend the biodiesel/renewable diesel blenders tax credit from 2022 to 2025. If this bill becomes law, the tax credit will continue to provide a substantial $1 per gallon incentive for entities that blend biomass-based diesel (both biodiesel and renewable diesel) with petroleum diesel. Advocates of this legislation continue to promote how important this tax incentive is to support economic growth and reduce greenhouse gas emissions. But, at Turner Mason & Company (TM&C), we asked ourselves, is this tax policy really needed to accomplish these goals?

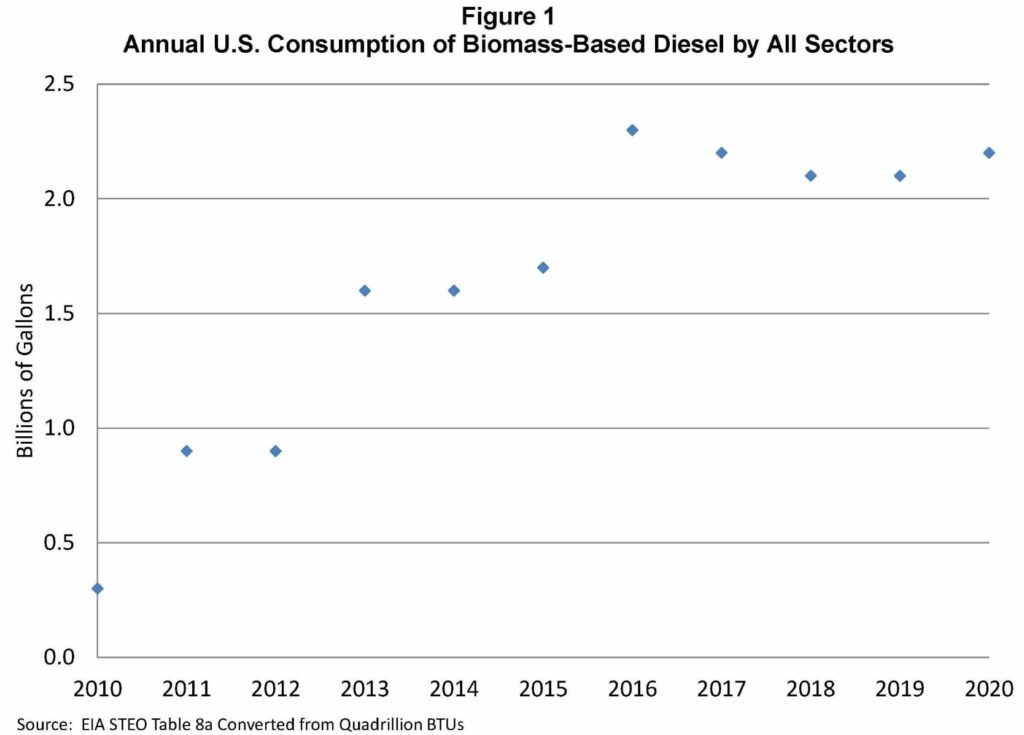

From an economic standpoint, biodiesel and renewable diesel need price incentives to encourage blenders to buy and blend these renewable fuels. Historically, both biofuels have been more expensive to produce than diesel fuel. As an example, the biodiesel price premium above diesel fuel ranged from about $0.60 to $1.20 per gallon based on a pricing analysis for 2018. Therefore, without some sort of public policy intervention, investments into new production capacity would not happen, and the biofuels would not be produced and blended into diesel fuel. But in reality, annual biomass-based diesel consumption is approaching 2.5 billion gallons per year (see Figure 1 below), which leads to the question: has this growth been totally dependent on the Blenders Tax Credit, or is something else going on? Let’s take a closer look.

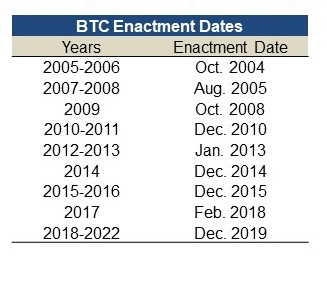

As can be seen from Table 1, the Blenders Tax Credit has been in-place for over 15 years: however, there has been some market uncertainty over whether it would be renewed, since it was in effect in advance for eight years and retroactively applied for seven years. So, we don’t think that the BTC is the sole driver of biodiesel/renewable diesel growth, especially in light of an inconsistent market signal (in-advance vs. retroactive).

Table 1

Based on our analysis, the Blenders Tax Credit doesn’t do all the “work.” We think that more importantly, the USEPA Renewable Fuel Standard (RFS) provides fundamental and primary support to the production and blending of these biofuels. The RFS sets an annual minimum mandated volume of biomass-based diesel blended into U.S. transportation fuel. Biomass-based diesel (BBD) and Renewable Volume Obligations (RVOs) are established annually and applied to all gasoline and diesel produced or imported in the U.S. Refiners and Importers must either buy and blend BBD or purchase D4 RINs to achieve compliance. The RFS creates a “demand” for D4 RINs (the currency of the RFS) which can be “supplied” only through the production/import and consumption of BBD, as a transportation fuel in the U.S. The purchase of BBD with RINs or separated RINs becomes a cost incurred by Refiners and Importers that is arguably passed on to the consumer at the pump. One can also argue that the Blenders Tax Credit has “subsidized” the D4 RIN price by discounting the price of biodiesel and renewable diesel.

So, what do we expect would happen if Congress does not extend the Blenders Tax Credit? Since both BTC and RINs are currently needed to subsidize the blending of BBD, which is mandated by the RFS, we would expect the D4 RIN price to rise to “fill-the-gap” to more fully subsidize the blending of BBD. In addition, we would expect gasoline and diesel prices to increase in response to higher D4 RIN prices due to increased costs by RFS Obligated Parties (gasoline and diesel fuel suppliers), since the Blenders Tax Credit has been borne by U.S. taxpayers.

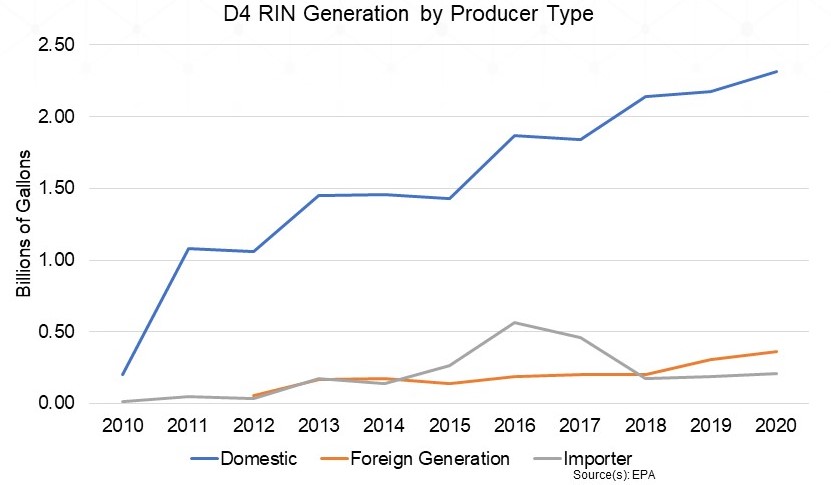

You may also be wondering what will happen if all the planned renewable diesel production capacity additions come on-line, as announced. One would think that the announced renewable diesel production capacity additions may provide for an over-supply situation, and BBD and D4 RIN prices may collapse. In general, however, USEPA has continued to increase the BBD mandated volumes and Obligated Party RVOs in response to production capacity additions, as required by the Clean Air Act. As such, we would expect BBD and D4 RIN prices to not have significant downward pressure in response to these start-ups, depending on how aggressively EPA continues to increase BBD mandated volumes/RVOs and continued D4 RIN “demand” by Obligated Party RVOs (as demonstrated on Figure 2 D4 RIN generation chart below produced using USEPA data).

Figure 2

Lastly, what do we expect would happen if Congress does extend the Blenders Tax Credit? We would expect more of the same. Any potential upward price pressure from the elimination of the Blender Tax Credit would come-off. We would expect the D4 RIN price to behave consistently with what has been observed historically. BBD/D4 RIN supply and EPA’s setting of the annual BBD RVO (with “spill-over” RIN demand to achieve both Advanced Biofuel and Renewable Fuel RVOs) will continue to be primary price drivers, along with a “discount” to reflect the lower price of BBD due to the Blenders Tax Credit.

In summary, we don’t think that an elimination of the Blenders Tax Credit would have a negative impact on BBD capacity additions and production. But of course, we will leave it up to the U.S. Congress and President Biden to decide “should it stay or should it go.”

Turner, Mason & Company’s Fuels Regulatory Practice will continue to closely monitor both legislative activities related to the possible extension of the Blenders Tax Credit and U.S. EPA’s Renewable Fuels Standards. Our practice has a wealth of experience spanning several decades in virtually all the clean fuel programs affecting refiners and marketers. Throughout its history, TM&C has provided consultation on EPA and state fuel programs in essentially all aspects of compliance. If you would like more information on our services or for any specific consulting engagements with which we may be able to assist, please visit our website:https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.