Published on

Tuesday, December 3 2019

Authors :

Robert Auers and John Auers

Listening to the old Manfred Mann tune (actually written and originally recorded by the Boss – Bruce Springsteen) “Blinded by the Light” the other day, the Electrical Vehicle (EV) hype machine came to our minds. There is no doubt the general public, egged on by the press, virtue signaling politicians and overly rosy forecasts, has many reasons to believe that EVs will soon take over the automobile market, make internal combustion engines (ICEs) obsolete, and save the world from fossil fuel caused “climate catastrophe.” We are constantly bombarded by stories about the rapid growth of EVs and the unveiling of shiny new plug-ins. These new “virtuous” vehicles are not only being brought to market by the perpetually overpromising Tesla, but also by most of the major car manufacturers. The latest “splash” entry into the field was recently one of the stars of last month’s trend-setting L.A. Auto Show – none other than a new all-electric 2021 Mustang Mach-E. This was the first major new addition to Ford’s signature model line in over half a century and its introduction caused an immediate bump in the price of Ford stock. High profile announcements such as the electric Mustang (and Tesla’s “Cybertruck”) are supported by fantastic projections from proponents about the coming EV boom and the imminent demise of the ICE; but, are these projections really likely to come true and are the fancy new EVs the “car/truck of the future”? More importantly to the petroleum industry, will they lead to imminent “peak demand” for oil? We have our doubts, and we explore why in today’s blog.

“And asked me if I needed a ride” – Likely in an ICE according to the numbers

While EV’s will continue to grow, the current dominant position of ICE’s is unlikely to be impacted in a major way for quite some time; and, as a result, we don’t expect EVs to exert major downward pressure on petroleum demand through at least 2030. As always, it’s all about the numbers, so let’s run through some of those. To start with, light duty transportation, which is the only real promising application for EVs to date, accounts for only about 25% of global petroleum demand. We often like to think that this is a higher percentage, and we believe this largely comes from the fact that light duty transportation accounts for about 45% of U.S. demand. Further, EVs will likely account for less than 2.5% of global new vehicle sales in 2019 and account for only ~0.7% of light duty vehicles on the road today. By 2030, we expect EVs to account for 13% of total new light-duty vehicle sales, but still make up only about 6-7% of total cars on the road. Even if 2030 EV sales were double our current forecast (or 26% of 2030 new car sales), EVs would still likely account for less than 10% of the total global vehicle fleet in 2030.

Assuming that all types of light duty vehicles are proportionally replaced by EVs, we could expect EVs to decrease global demand by ~1.6 MMBPD in 2030; however, the average EV tends to be smaller than the average ICEV, meaning that the actual impact on demand is lower – likely less than1 MMBPD in 2030 in our estimates. As an example, a consumer is more likely to replace a Prius or Civic than an F-150 with an EV. Since trucks and SUVs consume more fuel than EVs, the effects of EV ownership on demand will be diminished compared to what it might seem at first glance. By 2040, we expect EVs to account for ~16% of the total vehicle fleet globally – reducing global demand 2-3 MMBPD compared to where demand would be with zero EV penetration, a mere drop in the bucket vs. our expected total petroleum demand of around 115 MMBPD in that year.

“Told me I got what it takes” – And it still takes a lot of subsidy to sell EVs

Now, let’s get back to our EV sales forecast, which is somewhat bearish compared to some other prominent forecasts. One notable and highly publicized forecast is that from Bloomberg New Energy Finance. They predict that EVs will account for 25-30% of new light duty vehicle sales in 2030 and over 50% in 2040. These are roughly double the level of our internal estimates for each date. Still, our “bearish” forecast assumes an annual average growth rate in EV sales of 18.4% from now through 2030 and 7.3% for 2030 through 2040. This translates to an annual average increase of 1.1 million units of additional EV sales through 2030 and another 1.5 million units of additional EV sales each year for 2030 through 2040. To date, the largest annual increase in EV sales was an additional 770 thousand units sold in 2018 as compared to 2017; further, it looks as if 2019 EV sales will only slightly surpass those in 2018, and it remains possible that year-over-year (YoY) EV sales growth could be negative on a global basis this year.

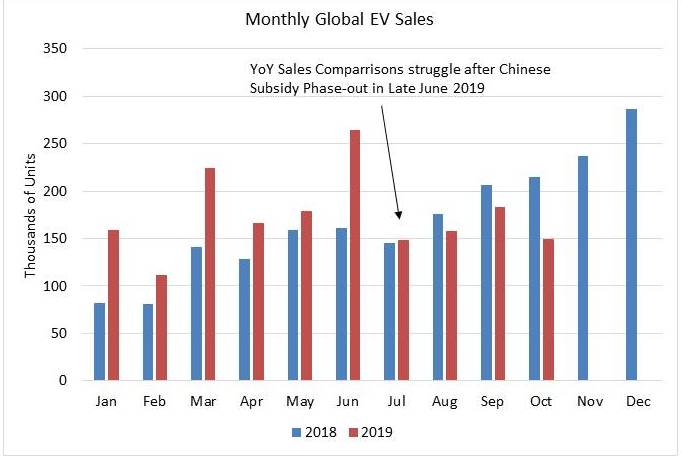

So, why don’t we believe the bullish EV sales forecasts? First, the explosive growth in EV sales over the past seven years has primarily been supported by government subsidies, as evidenced by the fact that EV sales fall precipitously whenever a government subsidy is removed. In Denmark, for example, EV sales fell by over 80% from 2015 to 2017 as the phase-out of EV subsidies began in 2016 and continued the following year. Similarly, Hong Kong EV sales fell by over 95% from 2015 to 2016, when EV subsidies were removed. Still, the most important EV subsidy phase-out is the one occurring right now in China, where a subsidy phase-out began in late June 2019. At this time, subsidies ended for all EVs with an NEDC range of less than 250 km and were halved for EVs with a range above this level. The remaining subsidies are expected to be completely removed next year. Still, many incentives for EVs remain and will remain in China, including priority registration for new vehicles in large cities and fewer limits on driving EVs during times of high pollution. Nonetheless, Chinese EV sales have fallen rather precipitously since June (even as EV sales typically surge in the back half of the year), with October 2019 sales down 58% compared to June, down 48% YoY, and down 10% compared to October 2017. We note June 2019 did see a surge of new EV registrations in China due to the impending subsidy phase out. As China had emerged as the primary driver of global EV sales growth over the past few years, this decrease helped lead global EV sales to decline 28% YoY in October. Also, As a result of weak Chinese sales data in the second half of 2019, Global EV sales for the full-year 2019 will likely only show single digit YoY growth and may even decline if sales come in weak for the final two months of the year. The figure below illustrates this trend.

We do not believe that the current level of subsidies is sustainable on a large scale and we believe that EV sales growth will slow considerably (in percentage terms) as these subsidies are removed on a country-by-country basis. Lastly, there is some limit to the rate at which EV and battery supply chains and charging infrastructure can be built out. These limits will also help limit the growth rate of EV sales globally.

“Another runner in the night” – Some other trends to consider

Increasing efficiency, on the other hand will have a much larger effect on demand growth going forward. Importantly, efficiency does not only reduce demand from light duty vehicles, but from almost all combustion-based petroleum demand. Efficiency continues to improve in heavy duty vehicles, airplanes, trains, and ships just as it does in light duty vehicles.

We also note that the shift toward SUVs and trucks continues globally, with the market share for trucks and SUVs reaching 36% in 2018, up from just 22% in 2014. We don’t see much evidence to indicate that this trend might slow down anytime soon and this demand tailwind will serve to mitigate some of the headwinds from increased EV penetration and improving vehicle efficiencies.

TM&C constantly monitors developments of all types impacting petroleum demand and potential substitutes/alternatives. We include our independent analyses of these impacts in our semiannual Crude and Refined Products Outlook, the most recent edition of which was released in late August, with the next edition, the 2020 Crude and Refined Products Outlook due out in February 2020. We are also considering developing a new study which will take a comprehensive look at supply and demand for renewable fuels and feedstocks, a multi-client study which we will be discussing in more detail in future blogs. For more information on any of these reports or on any of our other analyses or our consulting capabilities, please send us an email or give us a call at 214-754-0898.