Published on

Thursday, February 20 2025

Authors :

Sanjay Bhatia

Introduction

President Trump has announced intentions of imposing a 25% tariff on all Canadian and Mexican imports. Specific discussions about reducing this tariff to 10% on petroleum imports, which would include crude oil, have occurred. The proposed early February implementation of the tariffs have been delayed until early March to allow for ongoing discussions between the governments.

Refiners in the U.S. import significant volumes of Canadian crude, particularly heavy Western Canadian Select (WCS). Imports of Mexican crude, like the heavy Maya grade, have declined in recent years, but are still significant. PEMEX, the Mexican National Oil company, has seen declines in crude production, and aspire to process their crude domestically at the new Dos Bocas refinery.

The impacts of any proposed tariffs will be different for each refinery based on that refinery’s configuration and whether they have ready access to alternative crudes. Refinery configuration will dictate how much they can shift crude processing from heavy to light crudes and will ultimately impact the mix and volume of products, particularly gasoline and diesel, that can be produced.

Domestic U.S. crude production is primarily light crudes, while most imports from Canada and Mexico are heavy crude grades. Other heavy crude grades are available globally, but only to refiners with marine access to these cargos. Thus, refiners in the Midwest and Mountain West lack ready access to other heavy crude grades.

U.S. Crude Imports and Refinery Operations

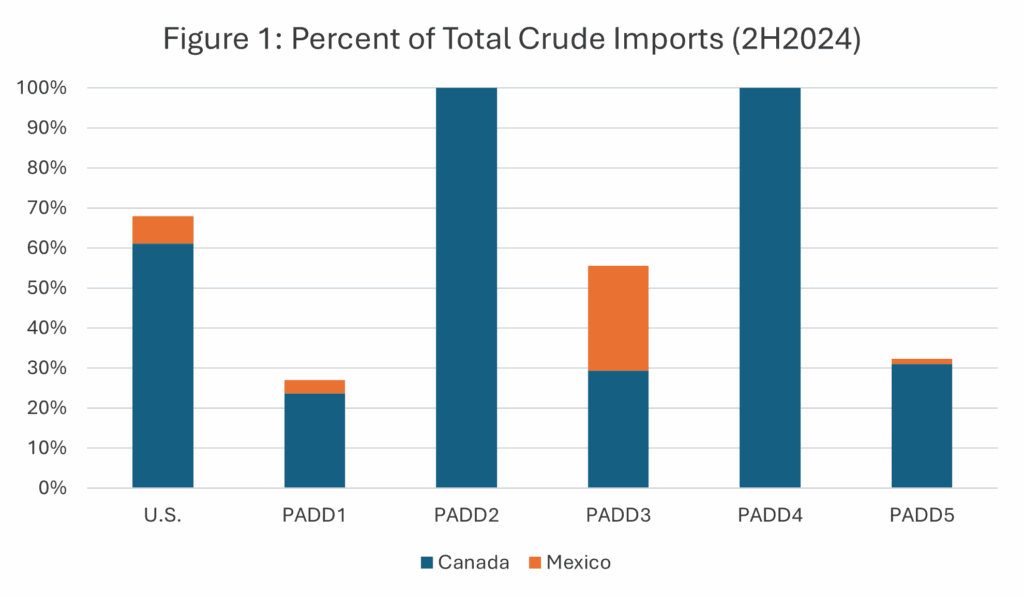

The U.S. imports over 4,000 MBD of Canadian crude, along with 450 MBD of Mexican crude. Because refiners run a mix of domestic and international crudes, overall, Canadian crudes represent 25% of the 16,500 MBD U.S. refinery crude runs, while Mexican crudes are less than 3% of the total. Across the U.S., 60% of all crude imports are from Canada, while an additional 7% are from Mexico (Figure 1).

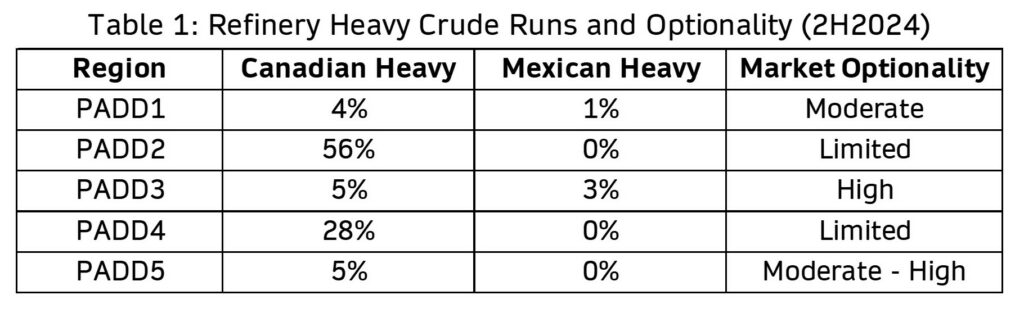

The Midwest refineries (PADD2) are highly dependent on Canadian crude oil, particularly the heavy WCS grade. 100% of all crude imports in the Midwest are from Canada (Figure 1) and represent 70% of refinery crude runs in the region, with the majority of this being heavy crudes (2,300 MBD) (Table 1). These refineries, should a tariff be enacted, would have limited ability to shift to other heavy grades, or replace with lighter crudes without hitting refinery operating constraints. Besides, many of these PADD 2 refineries are configured to process high volumes of heavy crudes.

The Mountain West refineries (PADD4) are similarly dependent on Canadian crude oil and face the same challenges. The entirety of crude imports into the region are from Canada (Figure 1), but Canadian crude only represents 45% of crude runs because of alternative crude access and refinery configurations. An overall 25-30% of total crude runs in the region are the heavy Canadian crude grades (Table 1), and much like the Midwest, the refineries’ ability to source alternative heavy crude barrels is limited.

The USGC (PADD3) refineries represent over half of all U.S. refining capacity and are some of the most complex and logistically flexible refineries in the world. Only about 17% of their total crude runs are imports due to their easy access to light sweet U.S. Shale crude oil. Most of these imports are heavy crudes to balance refinery runs. Nearly 30% of imports into the USGC refineries are from Canada via pipeline/rail through the Midwest, while another 25% of imports are from Mexico via marine movements (Figure 1). Overall, Canadian and Mexican heavy crude barrels represent over 8% of USGC refinery runs (Table 1). Because most of the refineries in the region have ready access to waterborne crudes from across the world, any tariff imposed would have minimal impacts as refiners will optimize their crude slates based on quality and price of crudes available globally.

U.S. West Coast (PADD 5) refineries have recently benefited from the Trans Mountain Expansion (TMX) pipeline starting operation in mid-2024. In addition to direct pipeline barrels into the Pacific Northwest (PNW), West Coast refineries are now bringing in additional Canadian barrels across their docks. TMX has resulted in an additional 150-200 MBD of Canadian crude landing in the West Coast, such that Canadian crude represents nearly a third of all imports into the region (Figure 1). Any tariff imposed would lead refineries on the West Coast to shift crude purchases to other global crude barrels. Additionally, Canadian producers would most likely shift sales of TMX barrels from the West Coast to Asia and the Middle East.

Impacts of a 10% Tariff on Refinery Margins

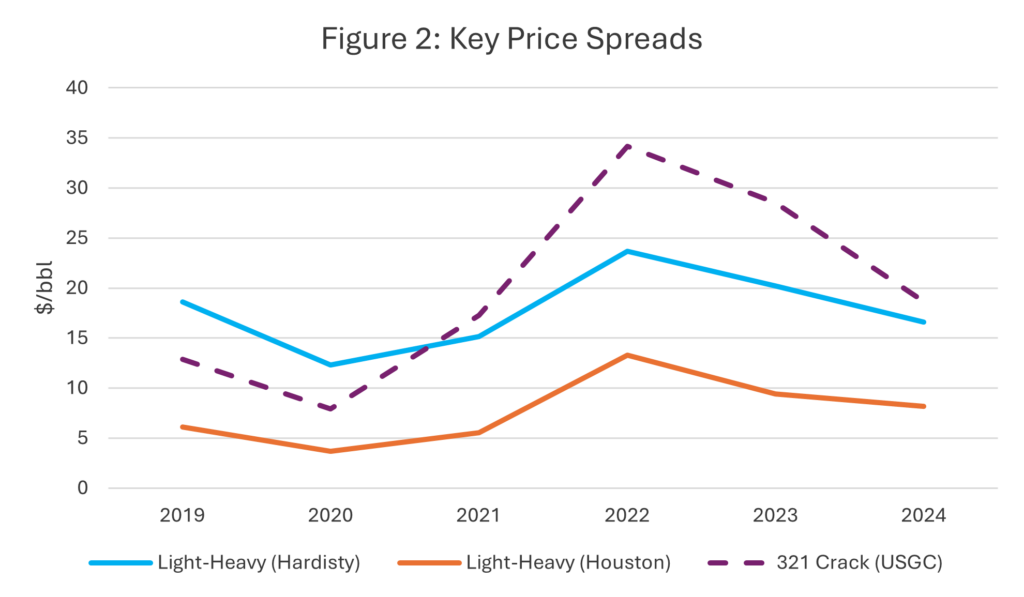

A crude tariff will ultimately impact crude producers, refiners, and consumers. If a crude tariff is imposed, it will be important to watch three price metrics to understand how much of the tariff is being absorbed by each party. An increase in the light-heavy differential (Figure 2), the price difference between a light crude grade and a heavy crude grade, can indicate crude producers (in Canada or Mexico) are having to absorb a portion of the tariff to maintain crude supply. A decrease in the crack spread (Figure 2), which measures the difference in product prices versus crude prices and is used as a surrogate for refinery margins, can indicate refineries are absorbing a portion of the tariff to maintain operations and product supply. Monitoring increases in product prices (all else being equal), particularly in regions where refiners do not have access to alternative barrels, can indicate consumers are absorbing some portion of the tariff.

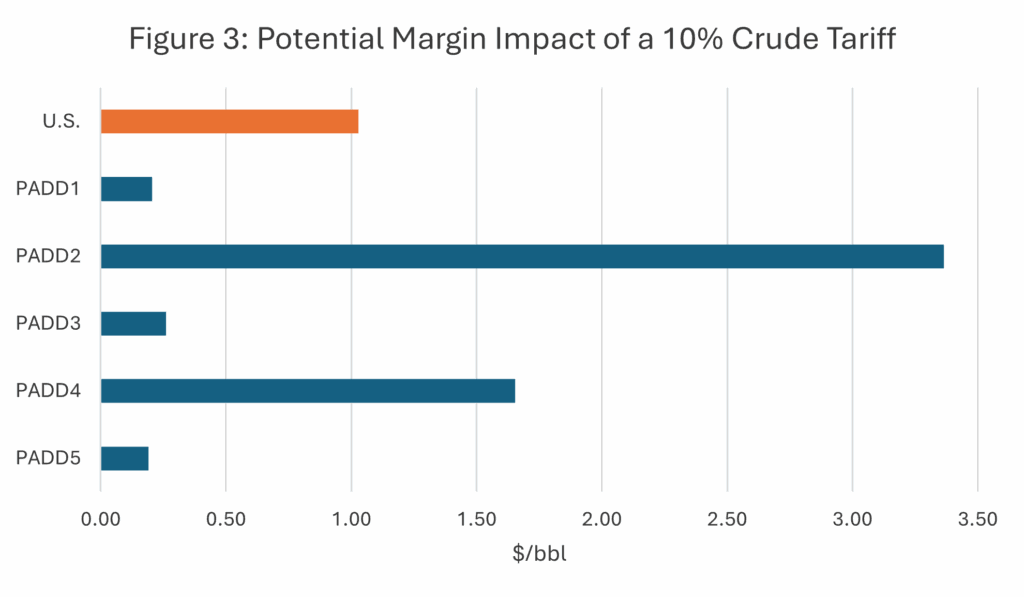

In today’s pricing environment where both WCS and Maya have been averaging about $70/bbl, a 10% tariff would translate to nearly a $7/bbl premium on Canadian and Mexican crude imports. Turner Mason has analyzed the potential impact of these proposed tariffs, with a particular focus on refinery profitability. Our analysis considered the volume of crudes being imported from both Canada and Mexico, the market pricing of these crudes, and the ability of refineries to replace barrels with alternative domestic or imported crudes. Replacement of heavy crude barrels, as mentioned, is particularly difficult for the Midwest and Mountain West regions. The potential margin impact of tariffs (Figure 3) into each U.S. refinery region (PADD) was calculated and represents the worst case scenario where the refiner absorbs the entirety of the tariffs. However, the ultimate split of a tariff between crude producers, refiners, and customers will depend on many factors. Overall, a 10% crude tariff could translate to a $6 – 7B per year margin impact across all U.S. refineries.

In today’s pricing environment where both WCS and Maya have been averaging about $70/bbl, a 10% tariff would translate to nearly a $7/bbl premium on Canadian and Mexican crude imports. Turner Mason has analyzed the potential impact of these proposed tariffs, with a particular focus on refinery profitability. Our analysis considered the volume of crudes being imported from both Canada and Mexico, the market pricing of these crudes, and the ability of refineries to replace barrels with alternative domestic or imported crudes. Replacement of heavy crude barrels, as mentioned, is particularly difficult for the Midwest and Mountain West regions. The potential margin impact of tariffs (Figure 3) into each U.S. refinery region (PADD) was calculated and represents the worst case scenario where the refiner absorbs the entirety of the tariffs. However, the ultimate split of a tariff between crude producers, refiners, and customers will depend on many factors. Overall, a 10% crude tariff could translate to a $6 – 7B per year margin impact across all U.S. refineries.

TM&C is actively consulting with clients seeking to evaluate tariff impacts. Current areas of interest around tariffs include:

| º | To what extent is there a potential for a divergence in light-heavy differentials between Hardisty and Houston due to stranded Canadian barrels vs increased demand on global (non-Canadian) heavy crude producers? | |

| º | For Canadian crude producers, how much of a tariff would they absorb, and what would be the likelihood of production cuts? | |

| º | Review of tariff splits between crude producers, refiners, and customers. Study the various factors including alternative crudes, refinery configuration, and alternative product sources (imports from other regions). | |

| º | A deeper dive into tariff impacts on either a PADD or an individual refinery basis. | |

| – Replacement with alternative heavy crudes vs optimization of crude slates with light crude barrels. | ||

| – Understand impact of refinery constraint. | ||

| – Margin impacts. |

For more information about areas we can assist you and your organization around tariffs or any other areas of the energy landscape, please reach out to us at contact@turnermason.com or give us a call at 214.754.0898.