Published on

Tuesday, November 12 2019

Authors :

Eamon Cullinane

OPEC released its 2019 World Oil Outlook last Tuesday (November 5) giving some insights into the impact of the IMO 2020 low sulfur bunker fuel regulations. In today’s blog we will discuss some of the updates OPEC has made to their predictions as well as looking at some recent developments and price movements in the high sulfur fuel oil (HSFO) market. As we approach the January 2020 start date for the new rules, I was reminded of the famous Queen/David Bowie hit, “Under Pressure,” given that the recent price action may be indicative of a market under pressure and in transition as a result of IMO 2020 regulations.

A major point OPEC has made in their outlook is that the impacts will be less severe than previously predicted. OPEC notes the changing global crude slate to a lighter than anticipated mix will change feedstock quality to refineries and increase their ability to produce compliant fuel. Supporting this view is the number of refiners and ports/blenders that are coming forward and either started to or announcing plans to provide the 0.5% sulfur fuels for bunkering.

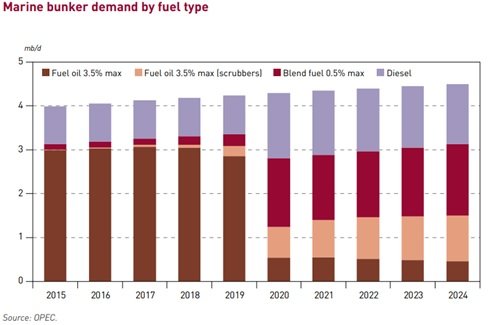

Here is a look at OPEC’s updated demand breakdown predictions.

The updated outlook has scrubber installations playing a larger part with HSFO demand from ships that have scrubbers exceeding 1 million BPD by 2024.

OPEC also has the view that market developments are reducing concerns about an unmanageable oversupply of high sulfur fuel. This is due both to the lightening of global crude supply (growth in light crude production combined with a drop in heavy crude supply) and the increase in vessel scrubber installations. The decline in HSFO prices will increase opportunities to replace declining volumes of heavy crudes in refining crude slates and also make residuals more attractive in power generation markets.

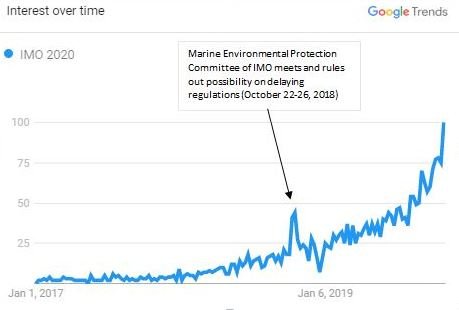

So, what is happening in the market today? IMO 2020 with good reason is being talked, written, and researched everywhere across the industry. Just take a look at the interest over time on google trends.

This past week has seen the most traffic to date regarding IMO 2020 as we draw closer to January 1, 2020.

With all the discussion surrounding the topic, it can be hard to really understand what is currently happening in the market. Often, one news outlet says one thing while another is saying the very opposite. In particular, we will discuss the current supply and demand market of HSFO and try to bring some clarity to the topic.

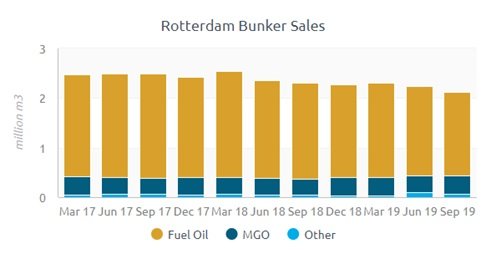

Market sources are estimating that over the past month 0.5% sulfur fuel oil blends made up ~50% of fuel oil bunker sales out of Rotterdam. We can also see below that sales in general have fallen with MGO remaining relatively flat.

Source: IMO 2020 Tracker Tool

Source: IMO 2020 Tracker Tool

Though most interesting (according to market sources), high sulfur is almost impossible to procure. Market participants are saying the HSFO market is extremely tight. Yet, if we look at another source, we see that there is falling demand for high-sulfur marine fuel oil in the port of Rotterdam as ship-owners prepare for the IMO 2020 sulfur cap.

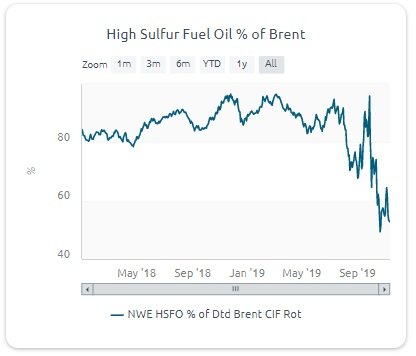

So, is the supply of high sulfur fuel oil fading or is demand for high sulfur fuel oil decreasing? If there were truly a lack of high sulfur fuel oil supply in the market, we should see upwards pressure on the HSFO price with respect to crude pricing. While if the issue were demand driven, the lack thereof would push the price of high sulfur fuel oil down. Here is where the price of HSFO currently stands as a percent of crude.

Source: IMO 2020 Tracker Tool

Source: IMO 2020 Tracker Tool

This trend would indicate that the market has an oversupply of HSFO as a result of a decrease in demand. So why do market participants keep saying they can’t get their hands on HSFO?

The reality is the ports might not have the storage for HSFO. In anticipation for January, a lot of ports/blenders have converted tanks over to store/blend 0.5%S IMO-compliant fuels. Yet, many ships still want HSFO over LSFO to take advantage of the price spread before January 1, but some ports/blenders are no longer set-up to handle such demands. So even though the market pricing indicates an oversupply of HSFO, some market participants are unable to actually buy the cheap fuel oil, which ironically only worsens the oversupply situation.

When everyone was worried about whether or not they would be able to pull up to a port and buy LSFO, it now seems that another worry might be that you won’t be able to buy HSFO. It would really be concerning come January if we see any cases of vessels with scrubbers installed purchasing LSFO at a port due to a lack of HSFO availability.

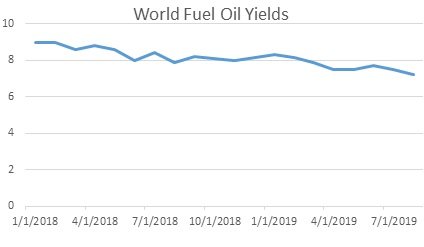

Another market comment we have seen is around global crude slates becoming lighter resulting in decreasing global fuel oil yields which results in less supply of residual fuel oil to the bunker market. It is true that the world has lost a considerable amount of heavy crude supply spanning from Venezuela, Mexico, Iran or some of the other OPEC countries. Though a large percentage of these crudes historically made their way to coking refineries where none or minimal residual fuel oil was being produced in the first place. Using JODI data, here is a look at the worldwide fuel oil yields by month through August of this year.

Fuel oil yields have only gone down a few percentage points over the last year or so, and it may be hard to tell how much is due to refinery upgrades vs. feed slate changes.

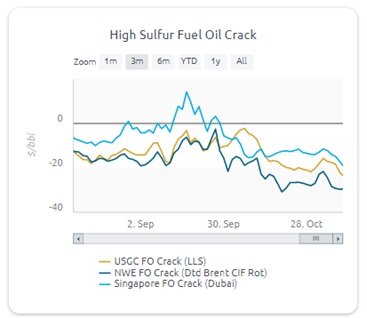

One thing that is certain is the volatility of the HSFO market. This, in itself, may be a leading cause of the confusion in what is happening in the market. Take a look at the HSFO Crack over the last few months.

Source: IMO 2020 Tracker Tool

Source: IMO 2020 Tracker Tool

All three regions have been trending downward with the differential now at $20-30/bbl discount in all regions in the span of months/weeks.

As the markets continue to evolve and come under pressure, use the Turner Mason & Company IMO 2020 Tracker Tool, an online interactive dashboard highlighting relevant crude and product differentials, crack spreads and refining margins across the U.S. Gulf Coast, Northwest Europe and Singapore. The Tracker also captures distillate and fuel oil stocks, fuel oil imports, and bunker sales. It provides daily updates on price movements of relevant crudes, refined products and refining margins.

Along with the 20+ interactive charts, each week, we will provide market updates, commentary and highlight specific graphs that we believe to be most relevant. Commentary coverage ranges from price spreads, fuel oil supply and storage, scrubber installations and overall IMO compliance levels.

If you have any questions about the IMO 2020 Tracker Tool or on any of our other analyses or our consulting capabilities, please send us an email or give us a call at 214-754-0898.