Published on

Thursday, July 25 2024

Authors :

Bailey Overton - Regulatory Consultant

In 2022, the U.S. Departments of Energy, Agriculture, and Transportation collaborated to establish the Sustainable Aviation Fuel (SAF) Grand Challenge. The U.S. aims to produce 3 billion gallons of SAF annually by 2030. The goal is to cover 100% of the aviation fuel demand with SAF by 2050, estimated at 35 billion gallons per year. The U.S. government seeks to stimulate investment and production of SAF via incentive credits, unlike the EU’s approach, which mandates SAF. Various federal and state incentives are in place to promote the scalability of SAF production while encouraging airlines to partner and pledge to reduce emissions through SAF implementation. Despite these incentives, the economic viability of SAF remains questionable. In this blog we will look at one of the current federal incentives and discuss why it’s too little and too late.

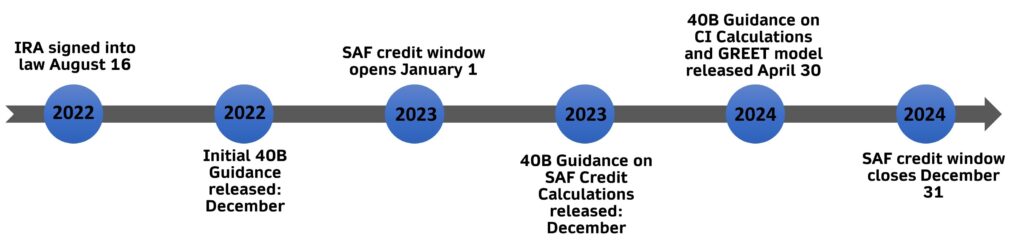

IRA 40B SAF Credit

The latest IRS guidance on Section 40B covering modeling fuel carbon intensity calculations and 40BSAF-GREET 2024 of the Inflation Reduction Act (IRA), released April 30, 2024, has sparked a plethora of questions surrounding the feasibility and value of the program. Under section 40B, producers of SAF have an opportunity to benefit from available tax credits, provided they meet the stringent requirements set forth.

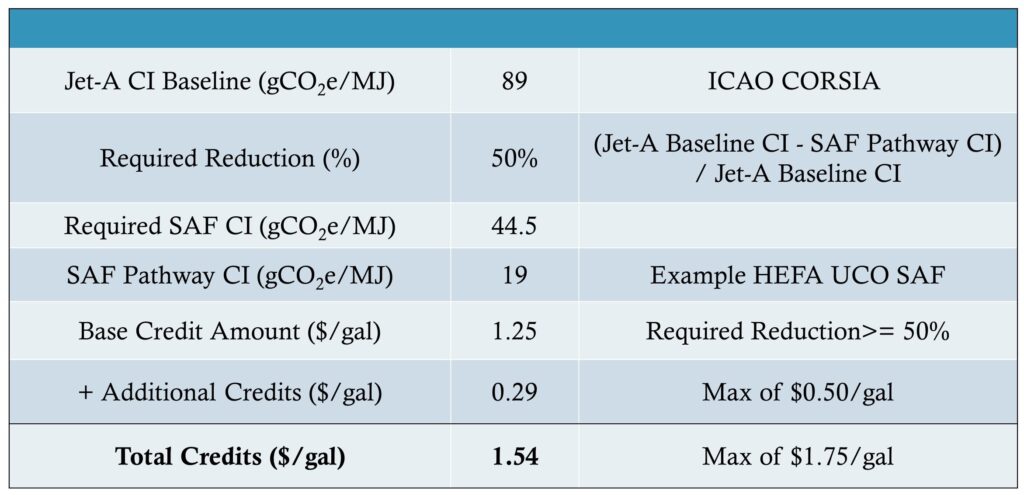

The IRA SAF tax credit includes a $1.25 per gallon credit available for each gallon of SAF sold as part of a qualified fuel mixture if the SAF has demonstrated lifecycle GHG reduction of at least 50% compared to conventional jet fuel. The tax credit increases by $0.01 for each percent of reductions above the 50% up to $1.75. Qualified fuel mixtures that meet this requirement must be produced, sold, used, or transferred into aircrafts within the U.S. after December 31, 2022, and prior to January 1, 2025.

Source: TM&C

Under 40B, two pathways (HEFA and ATJ) and seven feedstocks are approved for SAF production.

| * | U.S. Soybean HEFA |

| * | U.S. and Canadian canola/rapeseed HEFA |

| * | Tallow HEFA |

| * | UCO HEFA |

| * | U.S. DCO HEFA |

| * | U.S. corn ATJ-ethanol |

| * | Brazilian sugarcane ATJ-ethanol |

The IRS’s most recent guidelines introduces the 40BSAF-GREET 2024 model and outlines the parameters around the USDA’s Climate Smart Agriculture Pilot Program (CSA). The 40BSAF-GREET 2024 allows for SAF producers to reduce their CI using various mechanisms, including the new CSA pilot program, and production utilizing low CI hydrogen, electricity, RNG, or CCS. Table 1 below is a sample credit calculation for a UCO HEFA pathway.

Table 1: Example Credit Calculation for a UCO HEFA Pathway

40BSAF-GREET 2024

Default Carbon Intensity

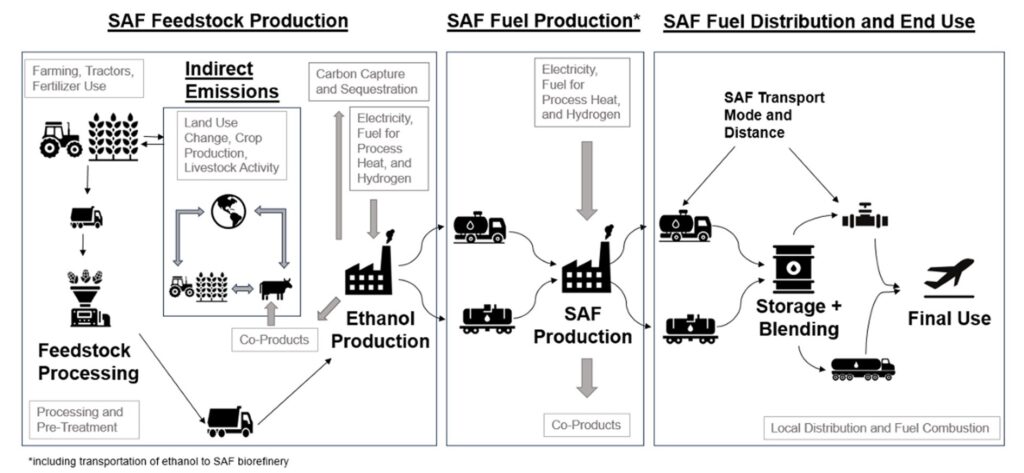

The 40BSAF-GREET 2024 was developed by the Interagency Sustainable Aviation Fuel Lifecycle Analysis Working Group which consists of the U.S. Department of Agriculture, Energy, Transportation, the Environmental Protection Agency and the Federal Aviation Administration. The 40BSAF-GREET 2024 model has a similar approach to that of CA-GREET CI Calculators. Users are limited to default emission factors and values that tie back to ANL’s Research and Development GREET model. Some inputs are site-specific such as product yields, electricity, process fuel, and hydrogen consumption at the SAF production facility. A full life cycle analysis model is depicted below in Figure 1 with a system boundary that accounts for emissions from farm to final use.

Figure 1: SAF Full Life Cycle

Source: U.S. Department of Energy

Indirect Emissions

Indirect emissions calculated in the 40BSAF-GREET 2024 model include land use change, livestock activity changes, and non-feedstock crop production changes. These indirect emissions were included because four of the seven approved pathways depend on feedstocks that are produced on dedicated land. The increased production of these feedstock crops could potentially induce changes in other parts of the agricultural system. For example, as demand for SAF rises, there could be a shift away from soybean toward corn production which carries emission impacts. With 40B, indirect emissions will vary producer to producer depending on their operational yields, whereas in the CA-GREET model, everyone is assigned a fixed ILUC value. These indirect emissions are calculated with SAF feedstock production for the HEFA pathways.

Carbon Intensity Reduction Projects

| * | Landfill RNG |

RNG consumption by the SAF production facility can be accounted for as a CI reduction, as long as the RNG is from a landfill that is directly connected to the SAF producer. To date, no facilities are directly connected to a landfill, leaving the reduction unclaimable without the allowance of book-and-claim.

| * | Zero CI Electricity |

Electricity from low-CI sources via behind the meter or via a renewable electricity credit purchase can also count toward a CI reduction. Again, no facilities to date are connected to wind and/or solar on-site and it is unlikely that any facilities will retrofit their facilities to include on-site wind and/or solar. Most likely renewable energy credits (RECs) will be utilized.

| * | Low-CI Hydrogen |

Low-CI hydrogen is allowed as well, which is calculated using the 45VH2-GREET calculator. For facilities that purchase hydrogen from a separate facility, book-and-claim accounting practices are allowed with 45V. If the SAF facility generates its own hydrogen on-site, that quantity should not be entered separately as hydrogen consumption but instead included in overall mass and energy balance of the facility.

| * | Carbon capture and geologic sequestration (CCS) |

Producers of ethanol can account for CCS by inputting the total carbon dioxide captured and stored into 40BSAF-GREET 2024. Unlike 45Q, this reduction opportunity does not include carbon utilization and must be geologically stored. Currently, no U.S. ethanol producers have on-site CCS capabilities, and given the timeline, it is unlikely that any will be put into operation before the credit window ends.

| * | USDA Climate Smart AG Pilot Program (CSA) |

The USDA CSA pilot program promotes additional CI reductions for domestic corn used for ATJ-ethanol and domestic soybean. Soybean farmers must practice no-till farming and use cover crops, along with the use of enhanced efficiency nitrogen fertilizer for corn production. If a SAF producer is able to meet the above requirements they would reduce their CI by an additional 5 gCO2e/MJ for soybean CSA crops and an additional 10 gCO2e/MJ for corn CSA crops. Given the guidance on CSA practices was released April 2024, it is entirely too late for farmers to participate in this program if they had not been historically implementing the CSA practices. Even if they had been utilizing no-till farming, cover crops, and enhanced efficiency nitrogen fertilizer, it is unlikely they have retained the necessary compliance documentation.

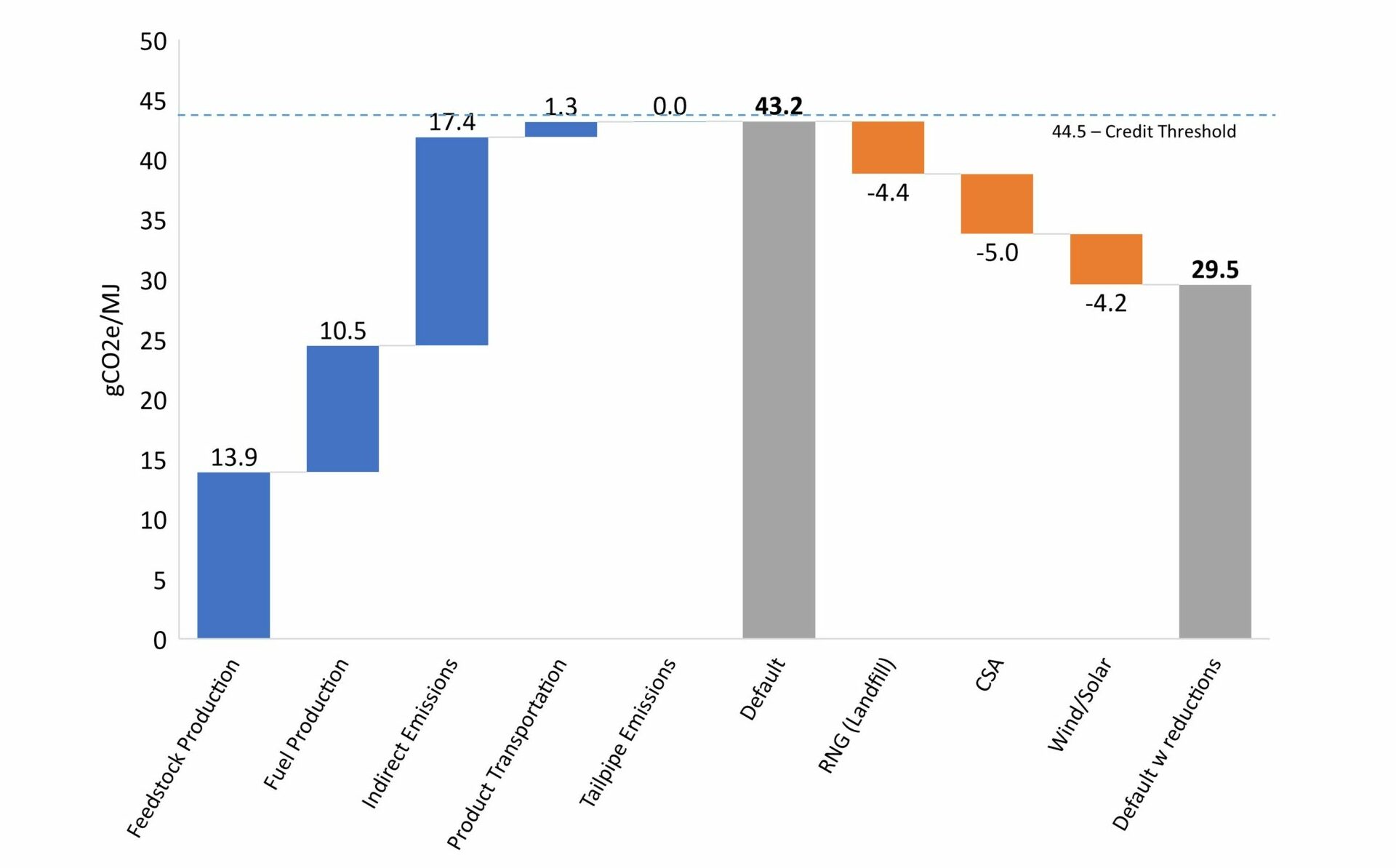

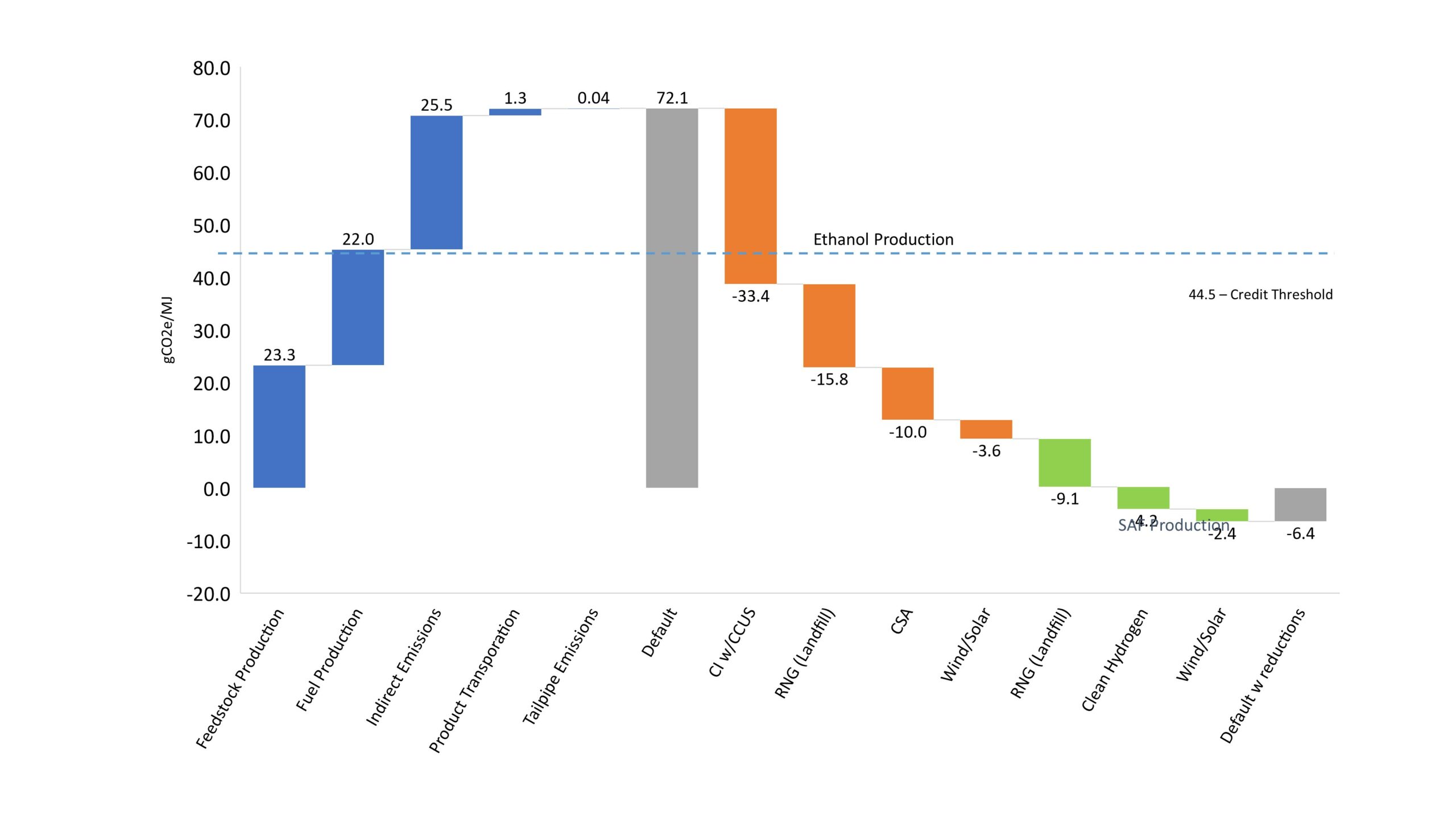

The graphs below depict the carbon intensity of a HEFA soybean oil pathway and of a U.S. corn ATJ-Ethanol pathway and how the emissions reduction projects would impact their CI values.

Figure 2: HEFA Soybean Oil – 40BSAF-GREET 2024

Source: TM&C

Figure 3: U.S. Corn ALTJ-Ethanol – 40BSAF-GREET 2024

Source: TM&C

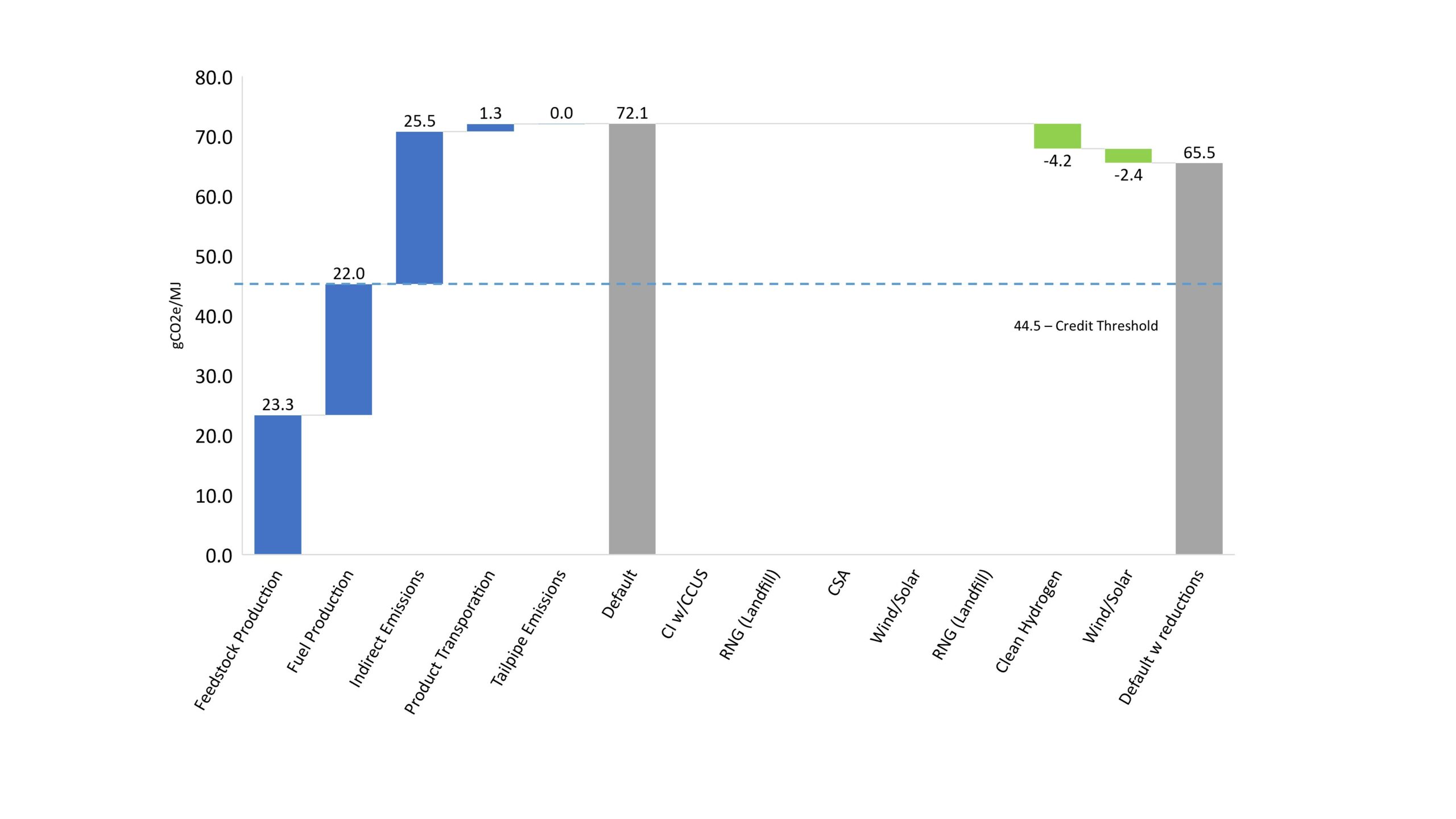

It should be noted that for ATJ-Ethanol pathways, one or more reduction mechanisms must be utilized in order for the SAF to reach the 50% reduction required for participation. No facilities to date are connected to a landfill or wind/solar farm, have CCS capabilities, and it’s doubtful that they would be able to participate in the CSA pilot program either. A more realistic CI for an ATJ-Ethanol pathway is modeled below.

Figure 4: U.S. Corn ALTJ-Ethanol – 40BSAF-GREET 2024

Source: TM&C

Conclusion

SAF production is currently limited due to costliness. It is more cost efficient to produce renewable diesel rather than SAF and 40B-approved feedstocks are being consumed by RD production leaving few options for SAF producers. SAF economics are more favorable when downstream customers are willing to pay additional premiums in addition to the government incentives. Currently, major corporates have demonstrated a willingness to pay these premiums in order to procure SAF.

Although the CSA program’s intent is to promote sustainable, environmentally friendly farming practices, the feasibility of recouping expenses via the 40B tax credit is questionable. While some farmers currently utilize cover-crops (5 – 10%), planting cover crops takes additional time and money and may take years to start seeing results. Implementing no-till, if not currently practicing, would require farmers to either modify their current planter equipment or invest in a new planter entirely. An additional limitation producers are facing is the set timeline for registration, certification, and production. It will be challenging for CSA farmers to plan and implement all farming practices and have them verified in time to receive the credits associated with 40B.

While 40B has noble intentions, its practical implementation poses significant challenges for farmers and producers, calling into question the overall feasibility of achieving the desired environmental and economic outcomes. The reality of the situation is that there is currently only three SAF producers in the US and the incentives laid out in 40B may not be achievable with current operational practices. SAF producers would need to employ multiple reduction mechanisms to approach qualifying for 40B by the end of the year. Given that the guidance continued to be released as late as mid-2024, it may be too late for producers to participate. Ultimately the 40B incentives were always too little and the guidance entirely too late to encourage participation.

It is still unclear if other IRA sections or the state-level incentives will be sufficient in the eyes of SAF and feedstock producers in order to scale SAF production to projected quantities. In the next blog, we will explore how certain US states are taking matters into their own hands and implementing more incentives to spark SAF adoption. However, the question remains: will these measures be enough?