Published on

Tuesday, January 14 2020

Authors :

Sam Davis and John Auers

2020 is shaping up to be another year of volatility for the downstream industry as crude prices, product demand, export markets, and refinery specific developments all have the potential to make headlines against a back drop of growing geopolitical tensions and the upcoming U.S. Presidential election. With IMO 2020 now in full effect as of January 1, the industry is also bracing for volatile swings in both product cracks and crude differentials due to the new rules, while nonrefining activity such as the pace of scrubber installations is becoming a key metric the global refining and shipping industries are closely watching. In this blog issue, we highlight some of the key issues, risks and opportunities we see for U.S. refiners as we begin a new decade.

Crude Prices –

The industry enters 2020 in a generally rising crude price environment (even before the Iran inspired roller coaster ride of the past 10 days) with WTI (Cushing) having risen from $53/bbl at the start of Q4 2019 to end the year at $62/bbl. The 4th quarter also saw OPEC and its allies agree to deepen oil production cuts by a further 500 MBPD through March 2020, giving support to crude prices. The first half of 2019 was volatile with crude prices rising steadily in the first quarter before falling sharply in the second quarter. During 1H 2019, U.S. crude production growth decreased significantly from the previous year, with growth averaging a modest 200 MBPD during the period, an almost 70% decline in growth from the same prior year period. As expected, most of the growth continued to come from the Permian Basin. Eventually, we ended the year with crude production rising during 2H 2019 but largely keeping WTI prices averaging about $55/bbl before the announced supply cuts of 1.7 MMBPD by OPEC and non-OPEC producers at a meeting in early December in an attempt to boost prices.

In 2020, we expect to see continued volatility in crude prices, with prices responding to both fundamental factors (supply and demand) and short-term market drivers such as geopolitics. We also expect the market to rebalance from the supply cuts and refinery runs to increase in response to demand for light sweet crudes to meet the IMO low sulfur fuel specifications. A key risk we see on crude prices is the role of OPEC in managing global supply and how it and its allies (primarily Russia) respond to falling or surging prices during 2020. A key factor, which makes us somewhat more bullish on absolute crude prices than most analysts, is our view that U.S. crude production growth will continue to slow in 2020, with a YOY increase of less than 400 MBPD (lower than consensus predictions). Of course, there are significant other uncertainties which could impact crude prices. These include geopolitical risks in the Middle East, North Africa, and Venezuela (among other regions), trade worries, changing attitudes toward crude price support following its recent IPO of Saudi Aramco, and of course global and regional economic health and its effect on product demand.

Refined Product Demand –

While the chance of a recession is always present, especially after the extended economic boom that has taken place in the U.S., we aren’t forecasting one for 2020. As a result, we do expect an increase in total refined product demand growth in the U.S. in 2020, although less than 1%. Globally, we expect total product demand growth to increase from 2019 levels, to average about 1.3%. Gasoline and distillate markets are expected to diverge from one another as gasoline markets both in the U.S. and globally are expected to be in surplus from lower demand and higher crude runs, while distillate markets will gain strength from higher demand resulting from the IMO fuel specification change. While expectations for transport fuel demand are for modest growth, we see continued increases in petrochemical demand, which will be supplied by new ethane crackers being built at the U.S. Gulf Coast and other regions around the world.

We see two main risks to product demand in 2020. First, how will demand respond to crude price volatility and a higher crude price environment? Second, what if we are wrong about U.S. and global economic growth and it is worse than currently expected? Certainly a factor that could lead to this is a worsening of trade tensions between the U.S. and China. While this risk was lessened by the recent Phase 1 deal agreement, the threat remains and could be a major downer for both economic growth and product demand on a global basis if it materializes.

Crude Differentials –

2019 saw favorable light crude differentials for U.S. refiners, with the Brent-WTI spread averaging over $6.70/bbl, providing margin uplift for most refineries processing domestic light sweet crudes. On the other hand, deep conversion refiners were burdened with the lowest heavy crude discounts since 2002, with the LLS (St. James) – Maya (FOB Mexico) differential averaging only about $5 per barrel for the year (due to loss of heavy barrels from Venezuela and other supply issues). These differentials should move in opposite directions in 2020, as Brent-WTI narrows (when pipeline constraints are removed to the USGC), while the heavy discount widens due to IMO impacts.

The Canadian crude discount narrowed significantly in 2019 as the Alberta government’s curtailment program lowered the WCS (Hardisty) vs. Maya (FOB Mexico) differential to below a $15 per barrel annual average (from almost $24 per barrel in 2018). This approximated rail delivery economics as available pipeline takeaway capacity continued to constrain options for producers to deliver crude to refining markets. While the lower differential was certainly a relief for producers, it did come at the expense of lower production due to the mandated curtailment. Towards the end of the year, the new Conservative government in Alberta began to loosen the curtailment from initial levels of about ~ 325 MBPD and has plans to remove it altogether before the end of 2020 (the original sunset date). As with the overall compressed heavy/light differential, the lower Canadian discount has negatively impacted profits of deep conversion refineries, especially those in PADD II.

Crude & Product Exports –

2019 was a record year for U.S. crude exports, which averaged about 3 MMBPD during the year (exceeding 3.4 MMBPD during the 4th quarter), up from 2 MMBPD in 2018. U.S. light sweet crude exports to Europe and Asia have been steadily growing since the oil export ban was repealed in December 2015, as this type of crude fits in well with the simpler refinery configurations prevalent in those regions. Declines in regional production of light crudes in those markets have also aided in providing room for the U.S. shale barrels. In 2020, we expect U.S. crude exports to continue growing, although the slowdown in production increases will also impact export growth. One thing that will not impede those volumes is logistics, as export capabilities along the U.S. Gulf Coast continue to be built, including the ability to use VLCC’s to reach distant markets.

Product exports continued to be strong in 2019, about equaling the record levels reached in 2018. These exports have become a critical factor in the ability of PADD III refiners to sustain crude utilization rates of almost 92% in 2019. An important factor in maintaining the high level of exports has been the inability of refiners in Latin America to operate their refineries, as refinery utilizations in Mexico and Central/South America continued to decline, averaging below 40% and 65% respectively, in those markets last year. We don’t expect this trend to change in 2020; and as a result, continue to see strong export demand for U.S. refined products.

IMO 2020 –

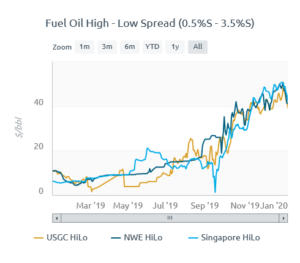

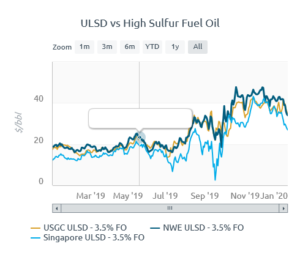

IMO 2020 is finally here and as expected we are already seeing price dislocations between low and high sulfur fuel oil (Figure 1) and distillate and high sulfur fuel oil (Figure 2) spreads.

Figure 1 Source: TM&C IMO 2020 Tracker Tool

Source: TM&C IMO 2020 Tracker Tool

Figure 2 Source: TM&C IMO 2020 Tracker Tool

Source: TM&C IMO 2020 Tracker Tool

During 2020, we expect to continue seeing more activities around low capital spend optimization projects designed to increase upgrading capacity through creep. We also anticipate additional scrubbers being installed as the shipping industry makes investments based on price signals from the bunker markets. The rate of scrubber addition could have the single biggest impact on how wide the distillate to fuel oil spread could be and how long it stays wide. Our current estimates show that less than 10% of total bunker demand today is high sulfur fuel oil consumed by ships retrofitted with scrubbers. While we expect scrubber penetration levels to reach 35% by 2025, this estimate remains subject to large uncertainty based on market developments over the next couple of years. As we monitor events throughout the year, we are also keeping a close eye on resid balances as excess resid competes with other substitution fuels in the power markets. We also expect feedstock competition in 2020 as FCC and Hydrocracker economics dictate availability and pricing of VGO.

We see a number of risks in the post IMO 2020 implementation. The first is the risk around ensuring consistency in compliance measures and enforcement procedures with penalties for noncompliance. Another key risk is on commercial distortions arising from compliance not being equally enforced across all markets. For instance, could crude supply be at risk if a refiner is waiting on a shipment and counterparty is not following rules? Also, what approach will be taken for the use of waivers if compliant fuels are not available at bunker hubs or segregation of marine fuels is not feasible in port bunkering?

Turner, Mason & Company continues to monitor developments in the U.S. and global refining industry, including those that impact regional competitiveness. We address industry risks along with our comprehensive market views in our Crude & Refined Products and Worldwide Refinery Construction Outlooks. We published our most recent version of these reports in August and our next editions will be completed and published to clients in February & August 2020. If you would like more information on these, or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.

Source: TM&C IMO 2020 Tracker Tool

Source: TM&C IMO 2020 Tracker Tool Source: TM&C IMO 2020 Tracker Tool

Source: TM&C IMO 2020 Tracker Tool