Published on

Tuesday, June 16 2020

Authors :

By Robert Auers and John Auers

Last week in this space, we provided our latest view on how quickly overall refined product demand would recover from the pandemic lockdowns (“Up Around the Bend” – What lies ahead for product demand and refiners’ prospects as COVID lockdowns ease – Part 2?”). To support our forecasts, we presented the latest positive trends in containing the spread of the pandemic, improving public perceptions and reactions to the pandemic, the easing of lockdown measures and the resulting early signs of a strong bounce back in demand, particularly gasoline. In today’s blog, we focus on the recovery for the most troubled segment of the refined product spectrum, jet fuel. Demand for jet has certainly taken the biggest hit from COVID, which is understandable considering the near total shutdown of air travel as fears of the pandemic raged during the early stages of the economic shutdowns. While a relatively strong bounce back has begun, a big question is whether it can be sustained. This issue was thrown more into doubt late last week as major news outlets trumpeted headlines highlighting a new resurgence in COVID cases in certain places around the U.S. and mentioned the possibility of slowing the easing of lockdown restrictions or even reinstating some measures. While we think this is mostly media bluster, continued pandemic developments and their threat to restarting the economy can’t be totally discounted either. A bigger question is how much residual impacts from COVID will impact air travel and resulting jet demand longer term. Certainly, business and international travel could be depressed for quite some time and a general cautiousness and fear of getting on an airplane at all will stay with some percentage of the population. In today’s blog, we examine these factors and how they will impact the desire to “Leave on a Jet Plane.”

“The dawn is breakin’ – Early signs of a bounce back

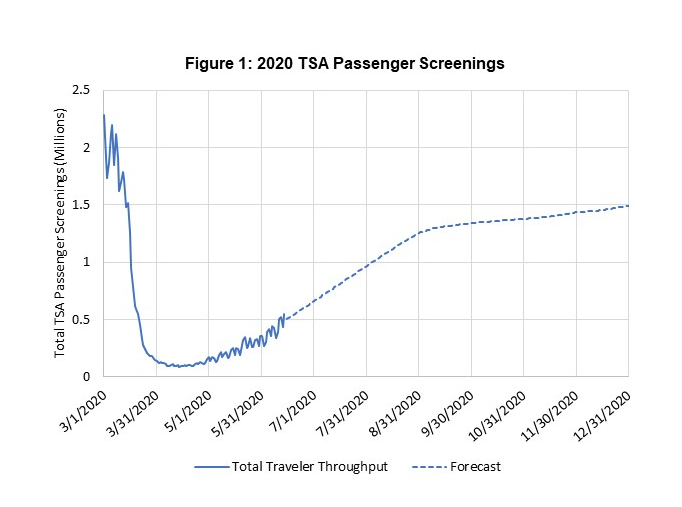

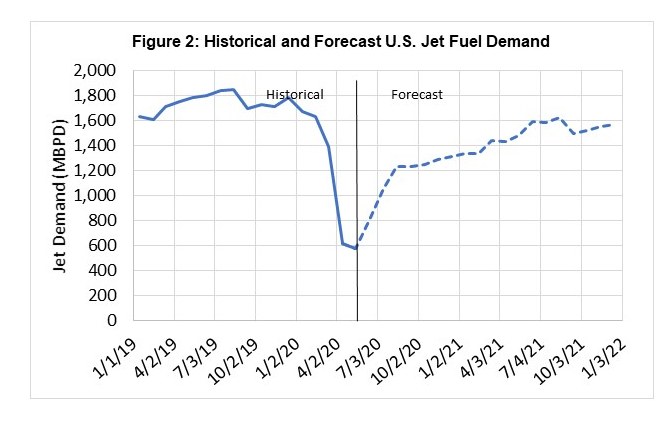

At the bottom, in mid-April, daily passenger levels in the U.S. (using TSA reported checkpoint counts) were below 100,000, just 4% of Year-over-Year (YOY) numbers. While jet fuel demand didn’t fall this much due to airlines continuing to fly routes at very low capacity levels, it was still down nearly 70% YOY, falling from 1.8 MMBPD in May 2019 to just 570 MBPD in May of this year. As a result, refiners have shifted most of their kerosene into the diesel pool. Passenger counts have begun to grow over the last month, topping the 500,000 mark this past weekend and are up five-fold from the lows, though still down by 80% YOY (TSA Screenings averaged 2.4 million/day in May 2019 and >2.5 million/day in June 2019). This early bounce back has been as strong as could be expected, with week-over-week growth running at about 25% since early May as shown in Figure 1 below. Going forward, we expect passenger count growth to slow on a percentage basis and follow a more linear path through the summer. By fall, the growth rate will likely slow further due to a continued lack of business travel demand and lingering COVID-19 fears among some portion of the population, with year-end passenger numbers approaching 1.5 million per day (about 60% of pre-COVID levels).

“Don’t know when it’ll be back again” – Prospects for complete recovery

As shown in Figure 1, we expect a continued strong bounce from the lows, but we remain cautious regarding the timeline for a full return to pre-COVID level of air travel and jet demand. Many people will continue to be fearful of flying for some period of time and businesses will be cautious with regards to resuming normal business travel. Travelers will be particularly reluctant to return to long distance international travel, which will also be limited in some cases by continued restrictions or other impediments in key destinations (New Zealand, Australia, and China, in particular). Many businesses will reconsider the value of some business travel, preferring to stick with teleconferences and ZOOM meetings in situations where they determine that the benefits of in-person meetings may not outweigh the costs. On-site conferences will also be slow to come back, further depressing business travel. Finally, the expected slowdown in overall economic activity resulting from the “scarring” of the COVID-19 lockdowns will act to slow both leisure and business travel. Taken together, while we see continued (although bumpy) growth in jet fuel demand over the next eighteen months, our short-term forecast, which is shown in Figure 2, anticipates that it will remain about 15% below pre-COVID levels by the end of 2021.

“One more time” – Lessons from the 9/11 experience

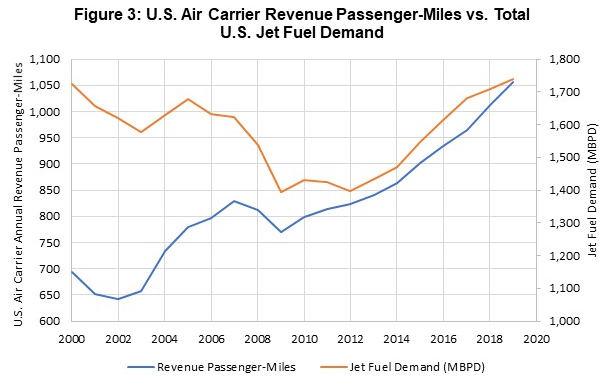

Although the COVID experience is certainly unprecedented, its impact does bear some resemblance to the hit taken on U.S. air travel and jet fuel demand after the terrorist attacks on September 11, 2001. After 9/11, U.S. jet fuel demand did not surpass the levels seen in 2000 until last year. This isn’t as bad as it sounds, however, since domestic revenue passenger-miles (RPM) surpassed 2000 levels by 2004, with improvements in operating efficiency among U.S. airlines and, to a lesser extent, improving aircraft fuel efficiency playing a major role in slowing the growth in jet fuel demand. This data is shown in Figure 3.

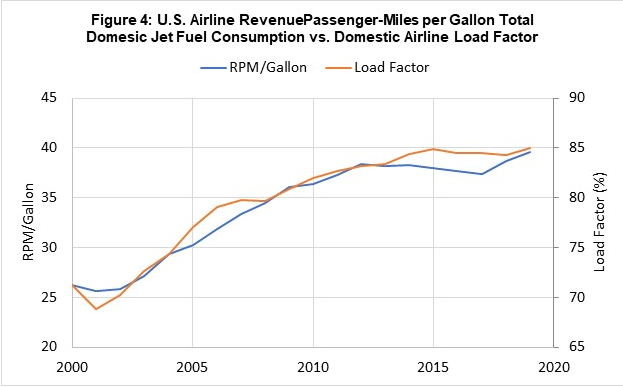

We’re now facing a much different situation than we were in 2001. In 2000, prior to 9/11, the U.S. commercial aviation industry operated with a load factor (occupied seats/available seats) of 71.2%. This number had been increasing since at least the early 1990s, as the industry continued to become more efficient following deregulation in 1978. After 9/11, the industry-wide load factor continued to increase until plateauing around 85% since 2015. This increase in load factor drove a consistent increase in RPM per gallon of total U.S. jet fuel consumption over the period. However, gains in RPM/gallon have stalled along with gains in the load factor since 2015 as shown in Figure 4. We expect limited ability for the industry to improve load factor much above 0.85 going forward; and in fact, it will likely decline in the short term as airlines add capacity. Also, while some continued improvements in aircraft fuel efficiency could drive RPM/gallon of jet fuel consumption higher, they are unlikely to come close to matching the industry-wide efficiency gains seen over the past two decades as most of the “low hanging fruit” has been harvested. For both of these reasons, we expect that jet fuel demand will generally correlate well with passenger levels in the future, unlike what was seen in the 2001 to 2015 period, with prospects for demand growth beyond 2019 levels possible once COVID impacts fade away.

Turner, Mason & Company will continue to closely monitor developments related to the COVID-19 pandemic, with a focus on how those developments might impact petroleum supply, demand, prices and the overall outlook for refiners and other segments of the oil industry. We will be commenting on our changing views on all these market trends in coming blogs over the next several weeks and incorporating our updated forecasts into our next edition of our Crude & Refined Products Outlook which will be published to clients in late July. If you would like more information on this publication or for any specific consulting engagements with which we may be able to assist, please visit our website: https://www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898. Please stay vigilant during these uncertain times and make good and informed decisions on personal interactions and hygiene practices.