Published on

Tuesday, August 25 2020

Authors :

Eamon Cullinane

In the wake of demand destruction as a result of COVID-19, refiners across the globe have been forced to turn-down rates or in some cases cease production altogether, while at the same time we have seen a handful of project announcements from refiners investing and retrofitting assets for renewable diesel production. In today’s blog, we focus on U.S. refiners who have made the difficult decision to shut down production and, in many cases, have pivoted to investments in renewable diesel.

Renewable diesel’s use is expected to increase across the U.S. Having reached the so-called “blend wall” with ethanol and biodiesel, parties with RFS obligations are turning to Renewable Diesel (RD) because it is not bound by biodiesel’s 5% blend rate. RD can be shipped on any petroleum diesel pipeline whereas biodiesel cannot. For traditional refiners, producing renewable diesel onsite is an increasingly appealing option since the existing processing hardware can be repurposed with minimal capital expenditures. It also eliminates the need to purchase biomass-based diesel RINs, which cost substantially more than ethanol RINs.

Refinery Closures and Reduced Utilization

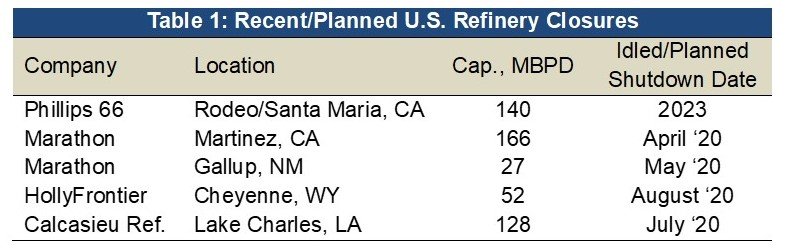

Numerous refineries have extended their maintenance and turnaround schedules in reaction to the recent decrease in demand, while four refineries have closed since March. Marathon closed it’s Martinez, CA and Gallup, NM plants in late April and early May and recently announced that they would stay permanently shut down. Holly Frontier and Calcasieu Refining have also recently closed their Cheyenne, WY and Lake Charles, LA. plants respectively.

As many in the industry are aware, when a refinery is “closed” it can mean a lot of different things. Often refineries are converted to terminals, sold and potentially restarted, or as in the case most recently, refiners have plans to repurpose into RD plants. (As is the plan for Holly Frontier Cheyenne Refinery).

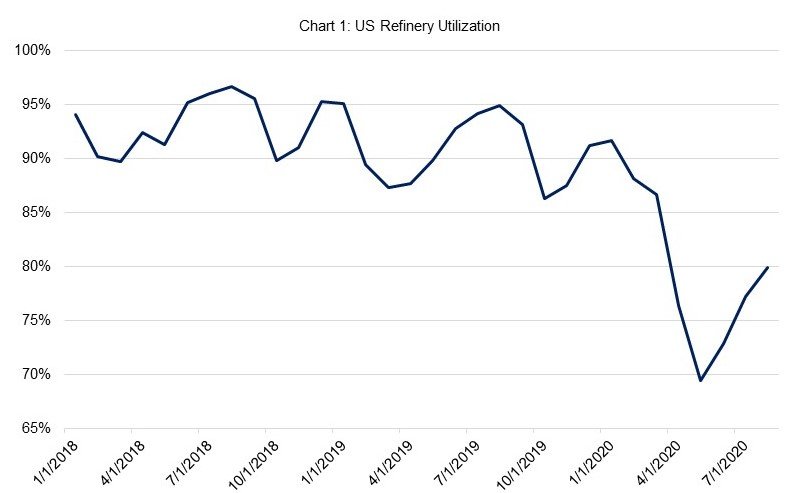

With global demand falling by almost 17 million BPD YoY and U.S. demand declining by over 4 million BPD in the 2nd quarter, refineries in the U.S. and around the world had to drastically reduce utilization rates just to keep inventories from exceeding storage capacity. On the USGC, percent utilization levels fell from north of 90% into the low 70’s in May and have only recovered into the low 80’s in recent weeks. While demand recovery is expected to continue, it will take until late next year (2021) to reach pre-COVID-19 levels.

Renewable Diesel Investments & Expansions

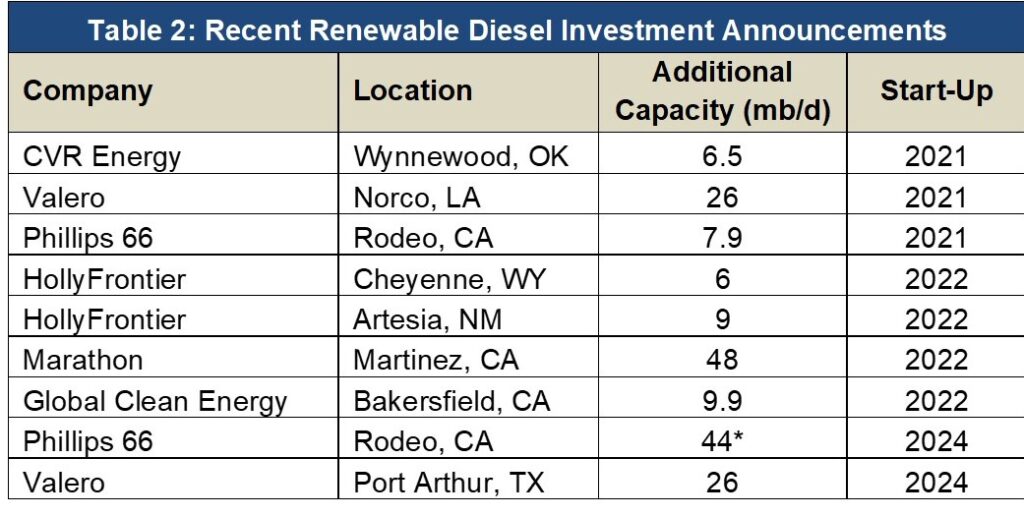

In the wake of announcing refinery closures, two of the world’s largest renewable fuel projects have been announced out of California. Phillips 66 is planning to convert the San Francisco refinery into an 800 MMGPY (52 mb/d) renewable naphtha, jet, and diesel plant while Marathon Petroleum is currently evaluating and will likely convert the idled Martinez refinery into a 736 (48 mb/d) MMGPY renewable diesel plant. Each plant currently plans to be at full capacity by 2024.

There are currently over 15 announced projects/expansions for RD over the next four years in the U.S. totaling close to 225 mb/d of possible additional capacity coming online. Here is a partial list showing the most recent major announcements.

*Includes renewable jet and naphta

*Includes renewable jet and naphta

U.S. Regulatory Incentives

As with petroleum refineries, these renewable projects will vary by feedstock, pretreatment, process technology, products, logistics and regulatory incentives (just to name a few). Each of these categories could be a blog topic on its own, so for today, we will limit our discussion to the regulatory incentives.

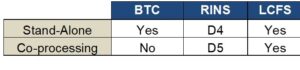

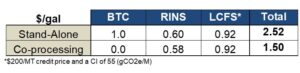

There are two types of renewable diesel projects: stand-alone and co-processing. Stand-Alone means processing only a bio-mass based feedstock into a renewable diesel component while co-processing means processing simultaneously a bio-mass based feedstock with a petroleum feedstock to produce a product made up of renewable and petroleum products.

Here is a quick breakdown of the major regulatory incentives that RD projects will look to capture.

BTC (Biodiesel Mixture Excise Tax Credit)

This is a federal tax incentive of $1.00 per gallon of pure biodiesel, agri-biodiesel, or renewable diesel that is available to producers/blenders. Although the BTC applies to both biodiesel and renewable diesel, the definition of renewable diesel does not include any fuel derived from co-processing biomass with a feedstock that is not biomass. So, depending on the project (if a co-processing facility or a stand-alone producer), this incentive may or may not be available. (Note this incentive is set to expire at the end of 2022)

RINS

All RD projects will be eligible for either D4 or D5 RINs dependent on the type (stand-alone vs. coprocessor) where each physical gallon of renewable diesel is assigned an equivalent factor of 1.7 RINs. Another downside here for co-processing facilities is the slightly lower value from advanced biofuel (D5) RINs vs. biomass-based diesel D4 RINs that stand-alone plants will receive. Refiners are familiar with RINs from the standpoint of an obligated party. As they expand into RD production, they will become a renewable fuel producer allowing them to offset their annual RIN volume obligation under the RFS.

LCFS

The last major incentive available to RD producers comes from the various low carbon fuel programs currently in California and Oregon, in the way of LCFS credits. Any RD producer who sends their product to one of these markets will be able to capture the LCFS incentive. Once again, another downside here for the coprocessor is that they will have to send all of their diesel product to these markets, even though only a percentage of the product will qualify as renewable and therefore receive the LCFS incentive.

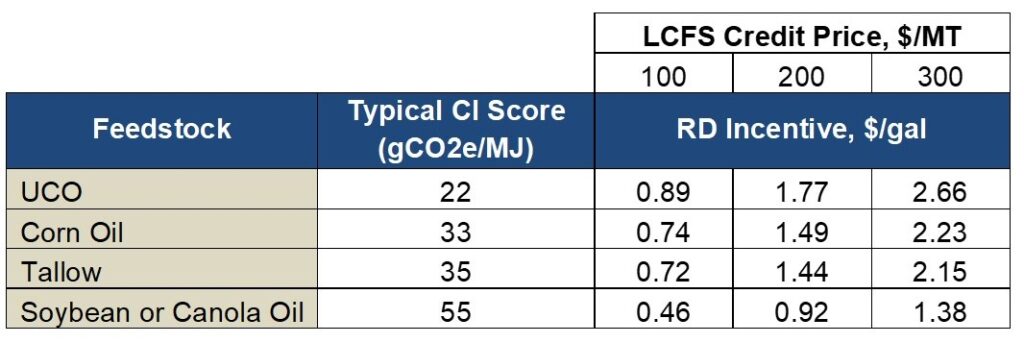

When it comes to LCFS credits, the carbon intensity (CI) will be the biggest determinant of how much value the product sent to these markets will receive. A large portion of the CI calculation is attributed to the feedstock processed, primarily the differences in the farming practices and the associated indirect land use for each feedstock. For example, P66 plans to use animal fats and UCO at the Rodeo, CA facility while the Global Clean Energy Bakersfield, CA facility will use Camelina sativa. The overall CI for each facility is calculated independently based on the feedstock and the energy used to process into renewable diesel. Therefore, each of these two facilities will receive different CI scores which will result in different incentives.

Here is an example of how the RD incentive can change based on both the feedstock type and the LCFS credit price.

After considering incentives from BTC, RINS, and LCFS, a RD producer who uses soybean oil as a feedstock in a $200/MT LCFS credit environment could be seeing a total $2.52/gal incentive while lower-CI feedstocks will see even greater margins.

As more and more companies rush to capture these incentives it will truly be a game of getting there first. There are a finite number of low CI-feedstocks and current producers already fighting to lock down a constant supply. New entrants into the market will have to be quick and strategic with their suppliers/partnerships if they want to extract the most benefit from these regulations.

Turner, Mason & Company has been active in the renewable diesel market for the past 10 years through single and multi-client engagements including due diligence of renewable diesel facilities. In response to growing market interest, our team is currently engaging with clients on renewable diesel market opportunities created by the various blending mandates. We are analyzing future supply and demand of renewable diesel, quality and sustainability of feedstock supply, and the economics driving existing plant conversions and new builds. For more information about renewable diesel market analysis or any specific renewable fuels consulting engagements, please visit our website: www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.

*Includes renewable jet and naphta

*Includes renewable jet and naphta