Published on

Tuesday, October 13 2020

Authors :

Eamon Cullinane

There are currently over 20 announced projects/expansions for renewable diesel (RD) over the next four years in the U.S. totaling close to 275 mb/d of possible additional capacity coming online. On a high level, there are mainly two types of renewable diesel projects, stand-alone and co-processing, yet each of these projects remains unique in terms of feed, location, technology, greenfield/brownfield, and many other aspects to name a few. In today’s blog, we will discuss the typical RD production pathways with respect to the required infrastructure, equipment and processing capabilities.

For traditional refiners, producing renewable diesel onsite is an increasingly appealing option since the existing processing hardware can be repurposed with minimal capital expenditures such as additional storage tanks, piping, heat tracing, and other equipment to introduce the feed at the refinery unit. Studies have also shown that co-processing does not significantly affect unit emissions and, therefore, no additional permitting is typically needed, helping keep operating cost marginal. Typically, a co-processor has three options to start producing renewable diesel: upgrade the unit’s catalyst, retrofit an existing unit, or lastly, build a grassroots unit; while a stand-alone producer only has two options: retrofit an existing unit or build a grassroots unit.

Catalyst Upgrade

At a minimum, a refiner could upgrade their catalyst along with a few operating adjustments to start co-processing; however, there are many issues that a refiner will run into that will limit production rates and feedstock quality requirements. Note, this is the one option that doesn’t exist for a stand-alone producer, and there is currently no catalyst upgrade that instantly makes a refinery FCC/HT unit run 100% bio-oil.

Independent of whether the bio-oil feed is introduced to a fluid catalytic cracker or a hydrotreater, there are various challenges of co-processing at the refinery.

|

Fluid Catalytic Cracker.

In an FCC, as the percentage of bio-oil being co-processed increases, pilot plant studies have seen an increase in coking, resulting in plugging of the feed nozzle.

Modified zeolite catalysts have been designed to be compatible with both a bio-oil and petroleum-based feed; however, even with an optimized catalyst, the bio-oil feed can feature many impurities (metals) that will react with the zeolite catalyst and reduce its performance and lifetime. The concern is similar to that of nickel and vanadium impurities often found in petroleum-based VGO feeds, but for bio-oil, the culprits are alkali metals like sodium and potassium. As a result, increased fresh catalyst additions will be required from an operational standpoint.

Hydrotreater

In hydrotreating the bio-oil, the main objectives are to remove the oxygen and to saturate any carbon double bonds in the bio-oil. As a result of the latter reaction, you are left with a lot of long saturated hydrocarbon chains resulting in a high cloud point. An upgraded catalyst (dewaxing catalyst) can help with this and improve the product cold flow properties by increasing isomerization reactions.

The reaction of the oxygenated molecules does, however, create a very fast and exothermic reaction in comparison to a normal petroleum-based feed. If not managed appropriately, it can manifest itself in both temperature and pressure increases throughout the reactor bed that will lead to coking/plugging which in turn will result in catalyst deactivation. This, along with the bio-oil impurities, can jeopardize catalyst performance and life.

Some of these effects can be mitigated by using increased layers of graduated catalyst beds that are designed to handle feed impurities and aid in uniform temperature and pressure profiles across the reactor bed.

Grassroots Unit or Retrofit Existing Unit

More often than not, simply upgrading your catalyst or increasing catalyst grading/loading will not suffice. The issues arising from co-processing typically require capital expenses to revamp and retrofit an existing unit or build an entirely new unit. This is even more so for stand-alone producers who face the same issues but at a greater intensity. Below is a list of investments typical of new or retrofitted units.

Fluid Catalytic Cracker

|

|

|

|

|

Hydrotreater

|

Capital Cost

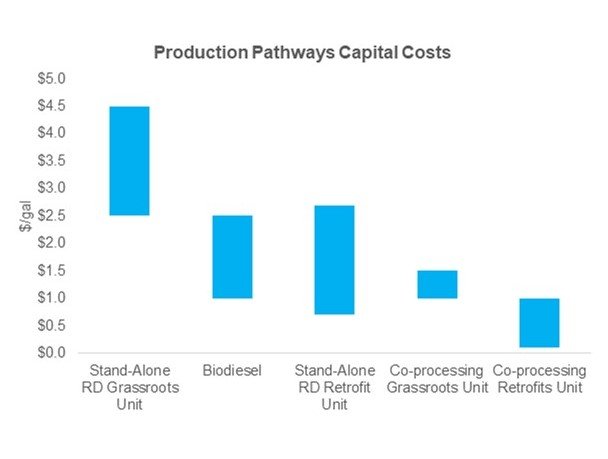

As mentioned before, producing renewable diesel from existing refinery units and infrastructure will require the least capital expenditures, but how does it stack up against the other pathways?

Here is a look at the various pathways and their associated CAPEX.

Turner, Mason & Company has been active in the renewable diesel market for the past 10 years through single and multi-client engagements including due diligence of renewable diesel facilities. In response to growing market interest, our team is currently engaging with clients on renewable diesel market opportunities created by the various blending mandates. We are analyzing future supply and demand of renewable diesel, quality and sustainability of feedstock supply, and the economics driving existing plant conversions and new builds. For more information about renewable diesel market analysis or any specific renewable fuels consulting engagements, please visit our website: www.turnermason.com and send us a note under ‘Contact’ or give us a call at 214-754-0898.