Published on

Tuesday, December 10 2019

Authors :

By Robert Auers and John Auers

On the heels of last week’s OPEC+ meeting and the flood of recent articles and reports calling attention to an expectation of an oversupply of crude oil next year, we decided it was worth outlining our somewhat contrary views regarding the global liquids supply and demand balance for 2020. The impetus for the expanded cuts announced by the OPEC+ group were based on their internal estimates calling for supply growth of 2.1 MMBPD from 4Q19 to 4Q20, compared to demand growth of only 1.2 MMBPD for the same period. OPEC expects the U.S. to continue to drive global supply increases by adding 1.3 MMBPD of new production in the next year, with additional gains coming from Norway, Canada, Brazil and Guyana. The IEA has echoed this sentiment, forecasting the call on OPEC crude next year to fall to 28.9 MMBPD, or ~1 MMBPD below November 2019 production – also due primarily to strong supply growth from the U.S. and the same view for relatively weak demand growth of 1.2 MMBPD. In response to these fears of oversupply, the OPEC+ group agreed to deepen their production cuts by 500,000 BPD last week, bringing total cuts to 1.7 MMBPD. In addition, the Saudi’s went even farther in adding 400,000 BPD of voluntary cuts. While the market has gained a bit in reaction to the announced cuts, bearish sentiment and a continued fear of oversupply remains. This fear is fed by doubts about OPEC compliance, worries about the exclusion of condensate from the OPEC quotas and unease about demand growth. While these are all legitimate concerns, we feel some other factors, which have been overlooked by some, could actually lead to a tighter market, especially if the OPEC cuts really materialize. We discuss our views on next year’s liquids outlook as we channel the lyrics of one of our favorite New Year’s tunes – “Ringing in the Year,” from the Turnpike Troubadours.

“And the situation went the way the situation went” – Where We Are Now

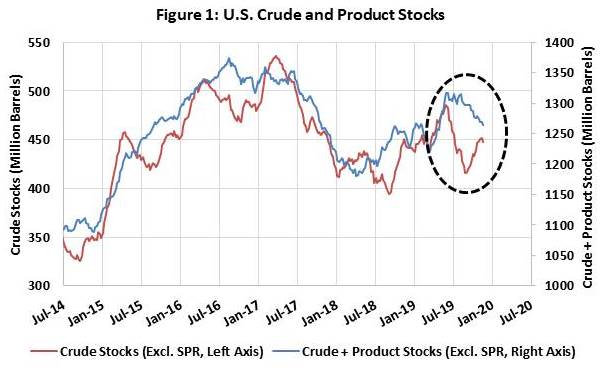

Let’s start by looking at the current supply situation. Simply using OPEC data for 4Q19 supply and demand, and assuming OPEC crude oil production averages 30 MMBPD in 4Q19, we arrive at a 710 MBPD liquids supply shortfall for the period. Internally, we expect this supply deficit to equal about 300-500 MBPD for the quarter. The EIA, in its November STEO, meanwhile, anticipates a slight supply surplus for 4Q19. Nonetheless, we believe the EIA is highly unlikely to be correct here as evidenced by the structure of the Brent forward curve and recent inventory trends. On the pricing side, the Brent forward curve remains in steep backwardation – a strong indicator the spot market is not oversupplied. Further, while U.S. crude oil inventories have seen a typical seasonal build through the first two months of the quarter, total liquid stocks have decreased as refinery runs have tracked below normal due to a heavy fall maintenance season in anticipation of higher margins in 2020 and the loss of PES in Philadelphia. We expect this trend to partially reverse next year as a weak spring 2020 maintenance season will help offset the loss of PES. Moreover, the continued increase in U.S. crude production and exports means that U.S. crude inventories are structurally higher than they have been in the past, as new pipeline and storage infrastructure has been built to accommodate these growing volumes. Figure 1 illustrates these inventory trends.

“Cheap champagne don’t dull the pain” – At least for U.S. E&Ps

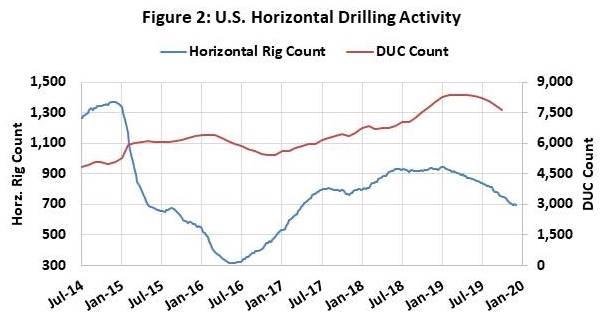

Our biggest difference with the OPEC and IEA forecasts, and the reason we could see a tighter crude market, is our much lower expectation for U.S. crude production growth in the next year. The S&P Oil & Gas Exploration and Production Index (SPSIOP) has fallen by ~1/3 over the past year- illustrating the general trend in broader investor sentiment toward the upstream industry. As investors increasingly shun the sector and those that remain demand real free cash flow, drilling activity and capital spending plans continue to see reductions. Figure 2 shows the decrease in horizontal rig counts and the monthly drilled but uncompleted well (DUC) count.

Looking at the graph, one can see that while the current rig count decline, which began in February this year, is significant, although much smaller than that seen from December 2014 through May 2016. Still, the drawdown in DUCs that began in May 2019, but accelerated in August, shows that the current growth rate of U.S. production is unsustainable unless drilling activity (and therefore rig counts) increases. This increase in activity would require an increase in capital budgets – something that Wall Street is unlikely to reward in the current environment. As a result, we expect a significant slowdown (which has already begun) in U.S. supply growth over the next 12 months with 4Q20 supply only about 600 MBPD above that in 4Q19. This is well below the 1.3 MMBPD increase forecast by OPEC.

Outside the U.S., another expected large contributor to non-OPEC supply growth is Norway, where production at the long-awaited Johann Sverdrup project began in October. The first phase of that project is expected to achieve its full production capacity of 440 MBPD by the middle of next year, but is already reportedly producing around 350 MBPD. Therefore, additional production gains at Johann Sverdrup from here are likely to do little more than offset declines from older fields.

“But I make no resolution of the kind” – Regarding 2020 Oversupply

Given the current supply situation, a moderated outlook for non-OPEC supply growth over the next 12 months, and OPEC’s resolve to prevent oversupply, we see little indication that forecasts for an oversupplied global liquids market will come to pass – baring a recession that sends demand growth below ~800 MBPD. Of course that recession scenario remains a possibility, and in our view, it remains the most important threat to an oversupplied crude oil and liquids market in 2020. Still, this is not our base case. Our main divergence from OPEC and the IEA is on our outlook for U.S. supply growth next year, where we believe these agencies are far too bullish given the recent declines in drilling activity. We expect this moderated supply growth to also lead to a more robust pricing environment next year and a modest increase in U.S. drilling activity by the end of the year, which will, in turn, lead to a slight acceleration in U.S. production growth in 2021 and 2022 before geology begins to increasingly limit the growth rate of U.S. liquids production (though we don’t expect U.S. production to peak until much later). We should add that IMO will also be a factor impacting crude markets. Those impacts will be complex and more properly addressed in more detail in a subsequent blog; although we can expect a generally “upward” push on light crude prices.

TM&C constantly monitors developments of all types impacting petroleum supply and demand. We include our independent analyses of these impacts in our semiannual Crude and Refined Products Outlook, the most recent edition of which was released in late August, with the next edition, the 2020 Crude and Refined Products Outlook due in February 2020. For more information on these reports or on any of our other analyses or our consulting capabilities, please send us an email or give us a call at 214-754-0898.