Published on

Wednesday, August 21 2024

Authors :

Bailey Overton

Introduction

The Inflation Reduction Act (IRA) 40B has left SAF producers and blenders with limited opportunities for participation. Given its short two-year credit window, coupled with delayed guidance and stringent regulations, 40B fails to provide the necessary framework for substantial growth in SAF production.

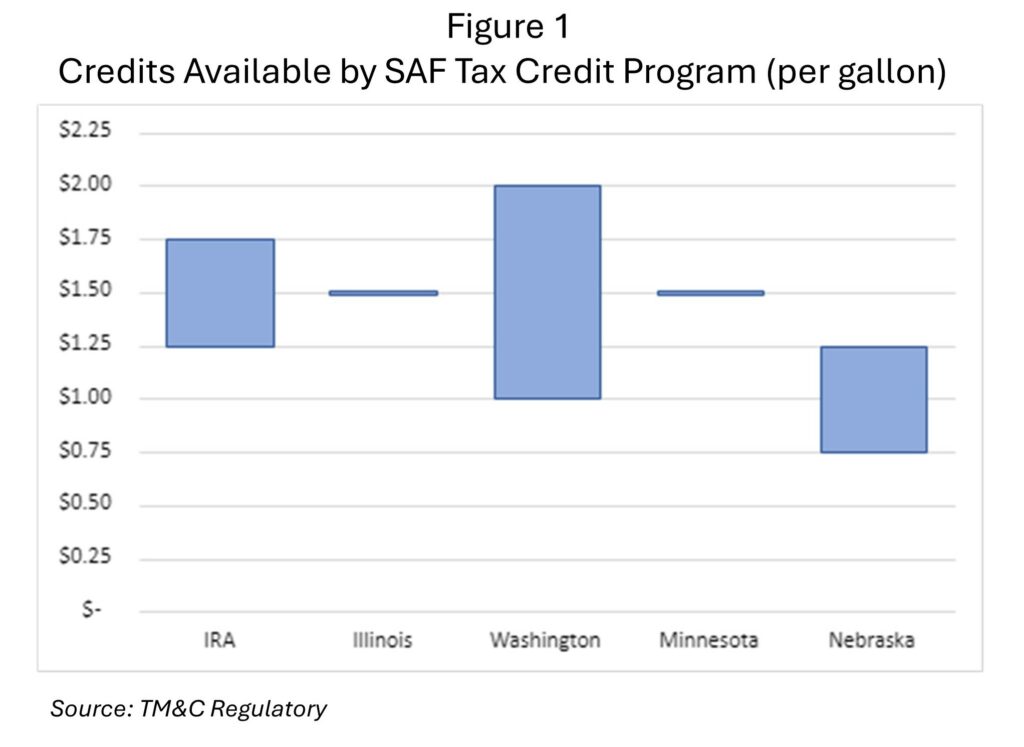

However, four states have implemented tax credit programs designed to stimulate SAF production and consumption within their jurisdictions. These state-level incentives promote progression towards the SAF Grand Challenge[1] targets by offering additional credits on top of federal incentives. With the IRA 40B falling short, state-level incentives present more viable opportunities for SAF producers and blenders. In this blog, we will dive into the four state SAF tax credit programs currently in place and explore further how credits will be captured.

Illinois

Illinois was the first to implement a SAF tax credit program at the state-level. Effective July 1, 2023, through December 31, 2032, this $1.50 per gallon credit will apply to SAF sold to or used by an airline common carrier in the state of Illinois. Credits are not applicable to SAF derived from palm/palm derivatives or soybean oil once purchases of soybean oil in the state have collectively exceeded 10 million gallons. Approved feedstocks include biomass resources, waste streams, renewable energy sources, or gaseous carbon oxides and can be sourced domestically or imported. Beginning June 1, 2028, feedstocks must be derived from domestic biomass resources solely.

Earlier this year, United Airlines signed an agreement with Neste to purchase 1 million gallons of SAF for use at Chicago O’Hare Airport through the end of 2024. With agreements already in place and Illinois offering a reasonable timeframe, this credit program may offer a viable option for SAF producers nationwide.

Washington

Washington’s tax credit program was implemented July 1, 2023, and the tax credit goes into effect once the department receives notice that one or more facilities are operating with a cumulative production capacity of at least 20 million gallons of SAF per year. The tax credit expires nine calendar years after the close of the year in which the tax credit takes effect.

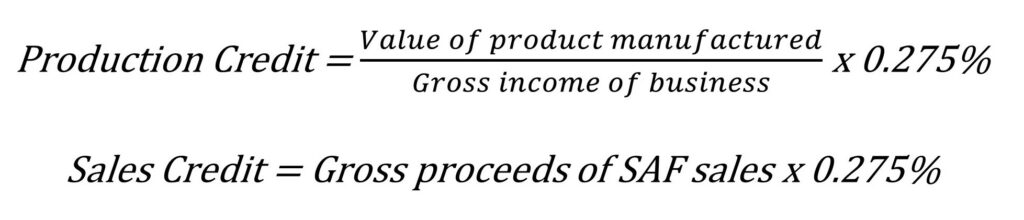

There is a $1.00 credit for each gallon of SAF that achieves 50% reduction of carbon dioxide equivalent emissions compared to conventional jet fuel and is produced or blended within Washington for flights departing the state. This credit increases by $0.02 for each additional 1% reduction in CO2 emissions, up to a maximum of $2.00 per gallon of SAF. The credit can be claimed for production or blending but not both activities. Notably, Washington accepts SAF that has been co-processed, a practice that is not permitted in other state-level programs or under IRA 45Z. Washington also has production and sales credits available; the formulas to calculate these credits are as follows:

Currently two companies have announced plans to build SAF facilities in Washington including Twelve who broke ground in 2023 (no operational startup date announced) and SkyNRG who expects to produce roughly 30 million gallons of SAF per year by 2029. With no set credit window and with the allowance of co-processing, Washington has set up a program that benefits producers of SAF within the state with intentions of extending the program if there is an increase in production by persons claiming the credit, does not result in additional pollution, and created measurable economic growth for the state.

Minnesota

In Minnesota, there is a $1.50 per gallon tax credit for those who produce or blend with aviation gasoline, or jet fuel in the state between June 30, 2024, and July 1, 2030. Facilities may claim the credit for either producing or blending SAF, but not both. Credit certificates may not be issued for more than to $7.4 million in 2025 and $2.1 million for 2026 and 2027, each. Any remaining credits for 2025 and 2026 are available for allocation through 2030 until the entire allocation has been made.

Additionally, SAF must be 1) used in aircrafts departing from an airport in Minnesota, 2) derived from biomass that does not originate from palm fatty acid distillates, 3) achieve at least 50% life cycle GHG (greenhouse gas) emissions compared to petroleum-based aviation gasoline, aviation turbine fuel, and jet fuel, and 4) the fuel production pathway achieves at least a 50% reduction of the aggregate attributional core life cycle emissions and the positive ILUC values under the life cycle methodology for SAF adopted by ICAO.

Minnesota will also offer a Construction Tax Exemption for materials and supplies used or consumed in and equipment incorporated into the construction, reconstruction, or improvement of a facility located in the state that produce or blend SAF. This exemption will be effective for sales and purchases of construction materials and supplies made after June 30, 2027, and before July 1, 2034.

Currently, no SAF production facilities are operational in Minnesota, but SAF blenders can utilize the tax as long as the fuel is used for flights departing from Minnesota.

Nebraska

Nebraska was the most recent state to implement a SAF tax credit program effective January 1, 2027, through January 1, 2035. Nebraska will offer a $0.75 per gallon credit for SAF that reduces lifecycle emissions by at least 50%, with additional credits for further reductions, and limited to $500,000 per fiscal year. An additional $0.01 credit will be granted for each percent of emissions reduction above 50% up to $0.50. SAF must not be derived from coprocessing (applicable material or feedstock that is not biomass) or from palm/palm derivatives.

On August 7th, 2024, DG Fuels announced plans to build a SAF production facility utilizing cellulosic biomass such as corn stover. Operational startup is set for 2030 with an anticipated capacity of 13,000 barrels per day. DG Fuels has already secured multiyear offtake agreements with Delta Airlines and Air France-KLM.

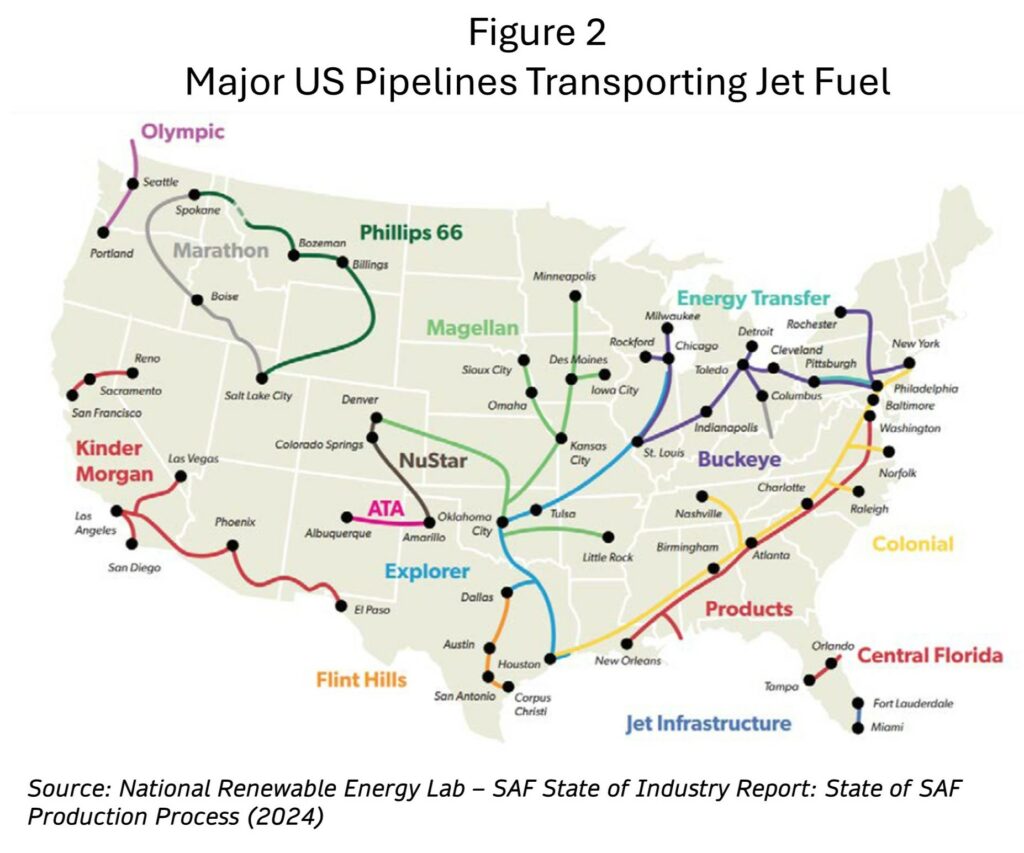

Distribution

With the four states promoting SAF tax credits located in the Midwest and Pacific Northwest, distribution is a major factor in participation. Fuel distribution is impacted by location of production, fuel type, and volume. Illinois, Washington, Minnesota, and Nebraska all have existing jet fuel pipelines that run either through or to their state. Neat SAF cannot travel via pipeline and would have to be delivered via truck, rail, or barge to a terminal or refinery for blending. If SAF is co-produced with conventional Jet A at an existing refinery, the fuel would move through the supply chain as usual via pipeline to terminals and onward to airports via trucks or pipeline. For these incentives to be cost effective, terminals and blenders would have to be in close proximity to airports in order to reduce the need for retrofitting existing infrastructure.

Conclusion

The U.S. is making positive strides in promoting SAF through a combination of ambitious goals and financial incentives. Between IRA 40B, state-level SAF tax credits, and credits granted through state-level low carbon fuels programs such as California’s Low Carbon Fuels Standard, Oregon’s Clean Fuels Program, and Washington’s Clean Fuel Standards, SAF producers will continue to have opportunities to capture credits.

In order for the SAF industry to continue developing, tax incentive opportunities need to be made available in other states. To date, one other state, Michigan, has introduced legislation to create a state-level SAF tax credit. Michigan aims to offer a $1 per gallon credit for SAF that reduces lifecycle emissions by at least 50% and is purchased in the state for flights departing the state. An additional $0.02 credit will be granted for each percent of emissions reduction above 50% not to exceed $2.00. State-level programs are needed to stimulate SAF demand and attract investments necessary to advance and grow the industry.

With these state-level credit windows expiring between 2030 and 2035, it is imperative that the producers and blenders of SAF secure offtake purchase agreements to help finance new construction projects. Currently, most offtake agreements span 4-8 years with many purchasers hesitant to commit long-term due to the unknown future of SAF production. If these incentives prove to be consistent and allow for profitable returns, we anticipate a surge of investments into SAF.