Published on

Thursday, October 24 2024

Authors :

Eamon Cullinane

In just the past four years, over $9 billion USD of capital has been deployed for the production of renewable diesel and sustainable aviation fuel in North America alone. At an average capital cost of $3.50/gallon of distillate capacity, it’s quite an expensive industry to enter. So where did all the money come from? This blog explores some of the ways producers have or are looking to fund these capital-intensive endeavors.

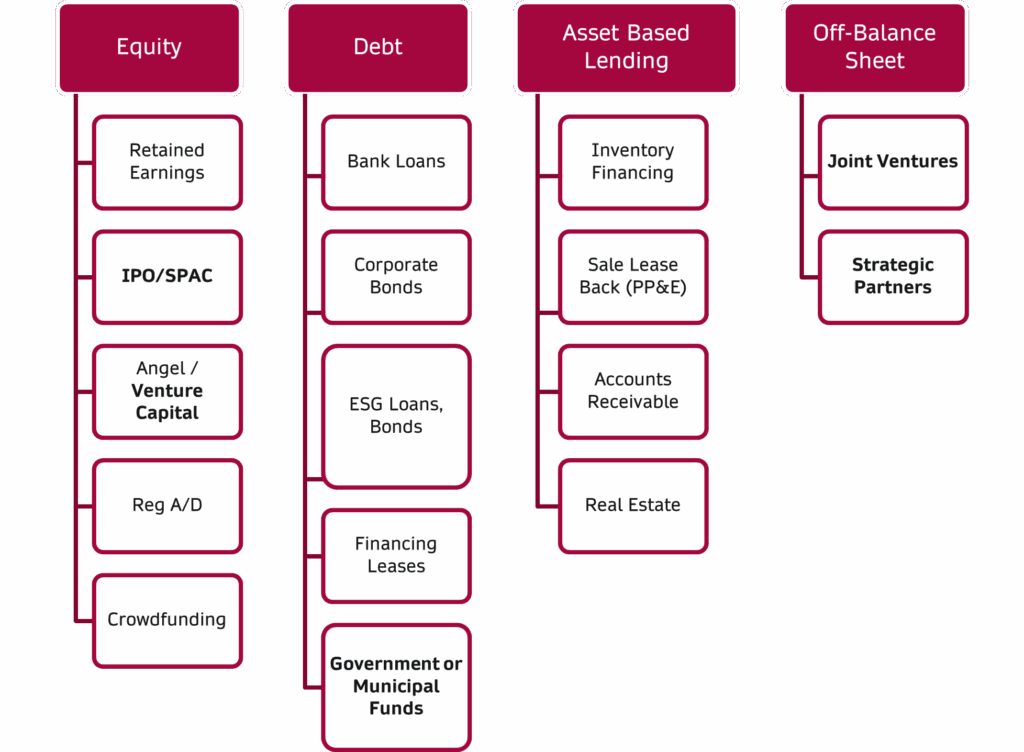

At a high-level companies have two basic ways to raise capital: equity and debt. Yet between these two board categories there are various instruments/funding vehicles that can be employed. Below is an outline of some of the major types of financing. While the list is certainly not exhaustive it does give a broad sense of the financial instruments a project developer might consider.

Joint Ventures and Strategic Partners

JV’s have been the most-widely successful approach in this space by helping de-risk projects and alleviate the need for a single company to take on all the investment. The major ones include Diamond Green Diesel (Valero/Darling), Martinez Renewable Fuels (Neste/Marathon), Saint Bernard Renewables (PBF Energy/Eni), and Heartwell Renewables (Love’s/Cargill). While on the strategic side, fuel producers have partnered with third-party hydrogen suppliers such as Air Products. In these partnerships, Air Products invest their own capital to build out the hydrogen capacity, resulting in lower upfront capital cost for the producer, but higher operating costs (the ExxonMobil/Imperial Oil Strathcona facility is a good example).

Government or Municipal Funds

One benefit of these renewable fuels projects is the ability to access federal and state level funding programs targeted at accelerating investments in low carbon and clean energy. Many state and local governments have developed tax exempt “Green” bonds aiding project developers with low-interest rate debt. While on the federal level in the U.S., there is the USDA Biorefinery, Renewable Chemical, and Biobased Product Manufacturing Assistance Program and the U.S. DOE Title 17 Clean Energy Financing Program. Just last week the U.S. DOE approved a combined $2.9 billion of conditional loans for Gevo, Inc. and Calumet’s Montana Renewables, both of which will use the funds to construct and produce sustainable aviation fuel.

Corporate Venture Capital (CVC)

This was discussed extensively in a previous blog, but it’s worth mentioning that LanzaJet is a notable example of a SAF producer that utilized CVC investments from the likes of British Airways, Southwest Airlines, Microsoft and others. The investment size of each is fairly small, but LanzaJet was able to build a large portfolio of these kinds of investors.

IPOs/SPACs

These are well-known pathways for private companies to go public and quickly raise large amounts of equity. North America hasn’t truly seen an initial public offering from a pure play RD/SAF producer, but there have been already public companies issuing more shares to directly fund capital. On the SPAC (special purpose acquisition company) side, XCF Global Capital (XCF) went public via Focus Impact BH3 Acquisition Co with the intended purpose to purchase the New Rise Renewables (44mmgpy Reno, NV) which started up renewable diesel production back in 2022. NEXT Renewable Fuels, Inc. (767mmgpy Port Westward, OR) also had plans to go public via a SPAC but ended up abandoning that approach. SPACs seem to come in and out of style, but historically don’t have a strong track-record.