Published on

Tuesday, March 25 2025

Authors :

Eamon Cullinane - Director, Renewable Energy Markets

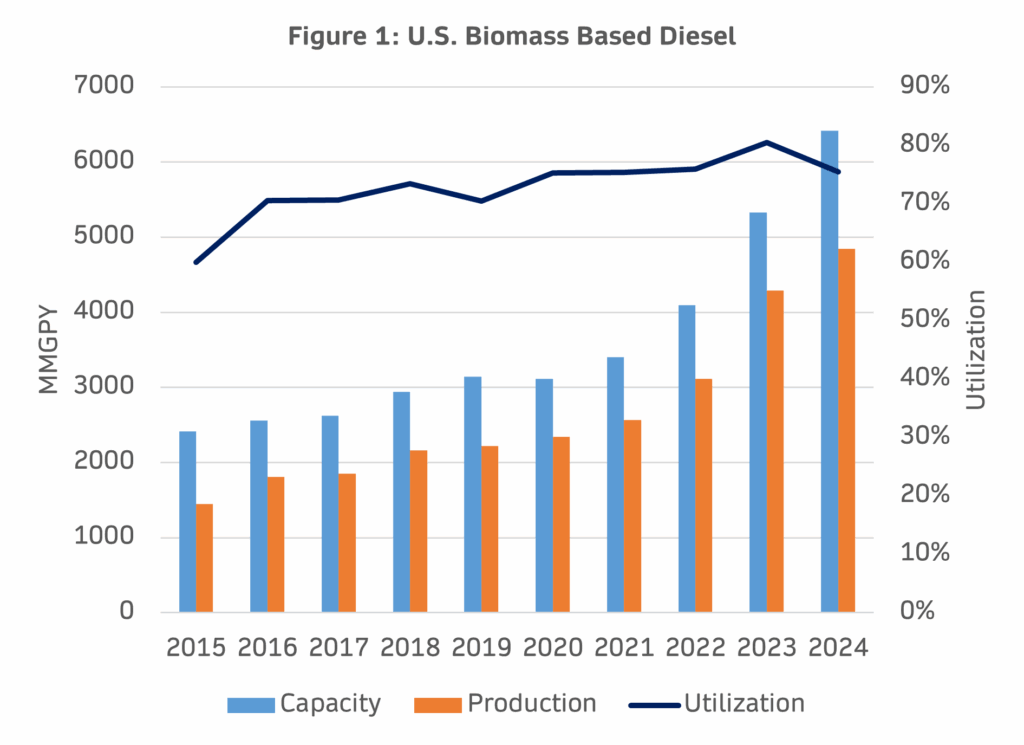

Production capacity of biomass-based diesel (biodiesel and renewable diesel) in the U.S. has grown to ~6.4 billion gallons as a result of the rapid growth of renewable diesel over the last 5 years. However, the industry is now facing the stark reality of rationalization. In both 2024 and 2025, the RFS RVO demand for biomass-based diesel (BBD) has and will fall short of production capacity, necessitating a reduction in supply. The market signal in the form of declining RINs prices (D4) has recently weakened margins for some producers into negative earnings. As the market adjusts, we can expect to see a combination of facility shutdowns/idles, along with reduced capacity utilization. The latter can be seen in Figure 1 where year-over-year utilization decreased 6% last year, down to 75%, the first logical step for producers to reduce supply.

Facility Closures

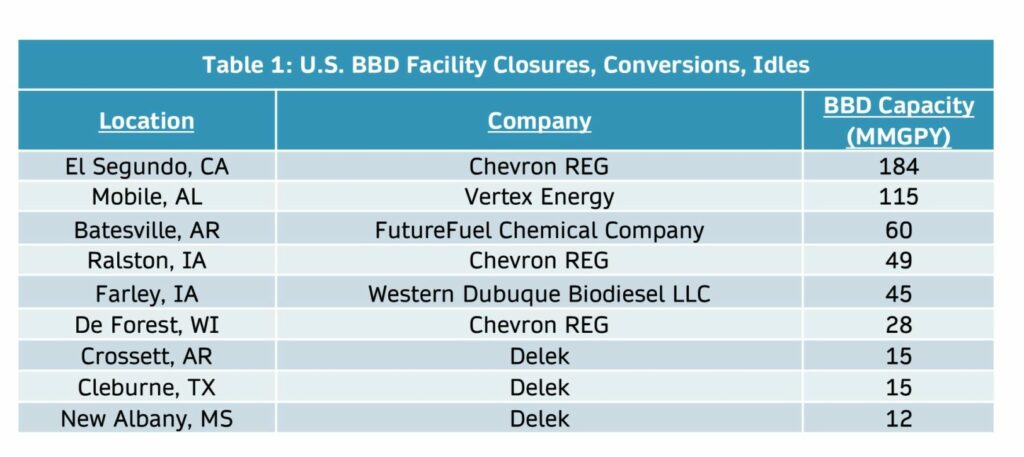

In addition to capacity utilization, a total of nine facilities in the U.S. confirmed they will be shutting down or idling production this year until further notice. Collectively these facilities represent close to 500 MMGPY of BBD capacity reduction (8-10% of the U.S BBD market) as shown in Table 1.

At Chevron El Segundo, poor economics at the end of 2024 led them to switch back into fossil fuel mode (most RD facilities do not have this option). Vertex Energy struggled as one of the only RD facilities in the U.S. without pretreatment, and eventually filed for bankruptcy emerging from chapter 11 earlier this year.

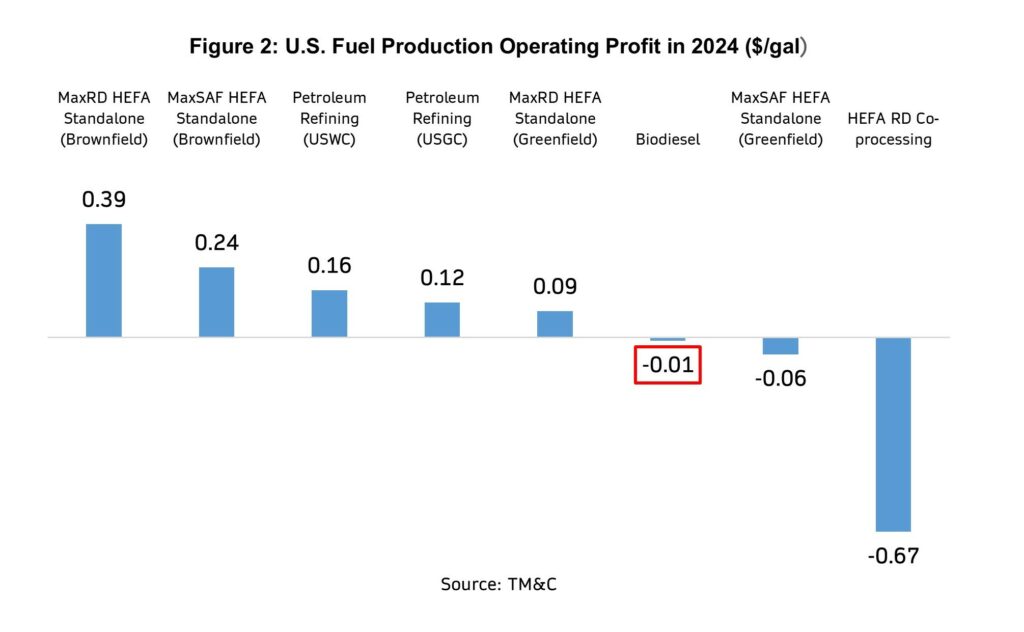

Seven out of the nine facilities that have closed are biodiesel producers. This is a direct result of biodiesel margins being challenged in 2024, particularly in Q4 which led many producers to extend turnarounds into facility idling as we entered into the new year. Figure 2 shows Biodiesel was breakeven over the entirety of 2024 while renewable diesel still maintained profitability, except for co-processing. Recall that co-processing did not receive the $1.00/gallon blenders tax credit.

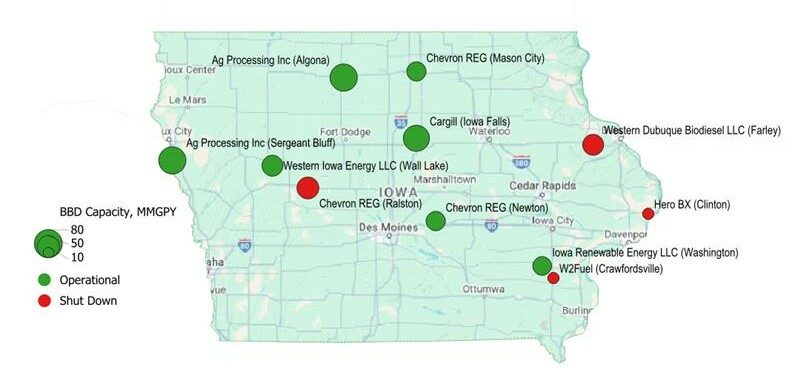

At the center of all this is Iowa, the heartland of America and the heartbeat of the biodiesel industry. At the start of 2024, it was home to 10 operating biodiesel facilities with a total production capacity in the range of 400-450 MMGPY (~20% of the biodiesel market). The industry alone supported 5,670 local jobs with a direct impact of $851 million on Iowa’s 2023 GDP (ABF Economics). The majority of these plants have been operating for 15-20 years but are now in jeopardy of permanently shutting down.

Figure 3: Iowa Biodiesel Facilities

Sources: TM&C, Public Announcements, EIA

On January 17, 2025, Monte Shaw, executive director of the Iowa Renewable Fuels Association, said “Our best estimate right now is 5 out of our 10 plants in Iowa are shut down. It could be higher than that, but that’s where we think we are now.”

In 2025, the U.S. biomass-based diesel industry will face a period of adjustment, driven by reduced imports, lower utilization, and potential shutdowns – each playing a crucial role in reshaping the market. While this may not signal a complete boom-to-bust cycle, it will serve as a necessary slowdown for an industry that may have been expanding too rapidly.