Published on

Tuesday, October 20 2020

Authors :

Guest - PLG Consulting

Today’s blog was written by PLG Consulting with input from TM&C and previously published on their website. PLG is a leading consulting firm operating primarily in the supply chain and logistics space. Like TM&C, they have been heavily involved with helping clients address challenges and take advantage of opportunities in low carbon fuel standard (LCFS) markets, including renewable diesel solutions. TM&C has collaborated with PLG on renewable diesel engagements to provide clients comprehensive process selection, market analysis and logistics/supply chain solutions. More information about PLG’s capabilities can be found on their website at www.plgconsulting.com.

Introduction

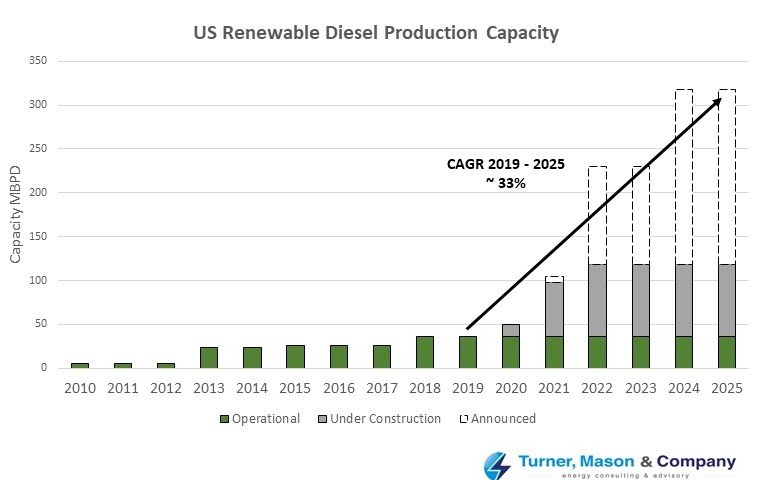

By the end of 2020, renewable diesel capacity is expected to reach 50,000 barrels per day according to Turner, Mason & Company (TM&C), a leading energy consulting and advisory firm, and is expected to grow at a 33% CAGR to over 300,000 barrels per day by the end of 2025. This growth projection is based upon TM&C’s industry knowledge of renewable diesel facilities that are currently operational, under construction and newly announced. In addition to the current renewable diesel projects under construction or newly announced, TM&C is aware of numerous other projects under consideration by various companies. Should all these projects proceed, the U.S. market will experience fluctuations in the supply and demand of renewable diesel. TM&C is actively monitoring these developments and providing updates of their outlook continuously. The expansion in capacity is being driven primarily by new environmental regulations says Cinda Lohmann, P.E., Vice President of the Fuels Regulatory Practice at TM&C:

“The low carbon fuel programs in California and Oregon are providing the primary incentive for growth of U.S. renewable diesel production. Turner, Mason & Company expects the regulatory incentives to hold strong as other regions across the U.S. consider adopting low carbon programs as a mechanism to achieve regional climate goals.”

Current U.S. renewable diesel production is primarily located in California, Louisiana, and Washington, with new production planned in Wyoming, Oregon, Texas, North Dakota, and New Mexico. Renewable diesel imports are mainly from Singapore. Additionally, new low carbon fuel programs being considered by other states include New York, Colorado, and the Mid-West states. All these factors combined point to double-digit growth and an incremental production of nearly 6x existing capacity by 2025.

As renewable diesel growth continues to gain traction in the U.S., it is signaling both inbound and outbound growth opportunities for the rail industry. PLG Consulting projects nearly a 1:1 inbound to outbound opportunity bringing feedstocks into refineries and the finished product out of the plants. The biggest advantage for the rail industry is that renewable diesel can be distributed using the existing railcar distribution infrastructure without requiring any specialized storage tanks.

Renewable diesel is different than biodiesel

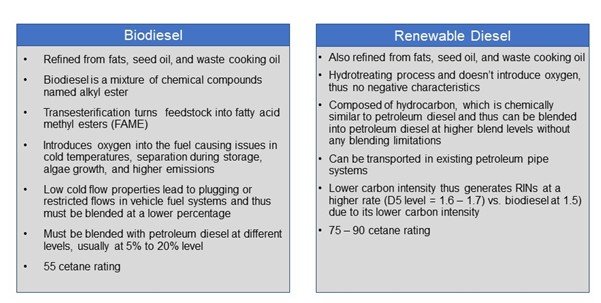

What is renewable diesel and how is it different than biodiesel? Renewable diesel is an advanced biofuel that reduces greenhouse emissions ~80% while meeting the same ASTM D975 specification as petroleum diesel. It is essentially a “drop-in” biofuel that requires no changes in engine, can be blended, and can be run in existing pipelines. Renewable diesel can be produced by triglyceride feedstocks including plant oils, animal fats (virgin and recycled), and used cooking oils. The process consumes hydrogen and liberates water, and propane is also made during the process.

The cost of the triglyceride feedstock is the largest contributor to the cost of production. Below is a chart describing the differences between renewable diesel and biodiesel.

Supply chain and logistics must be a key component of refiners’ strategy

Producers of renewable diesel face significant supply chain and logistics considerations when making the strategic decision to compete in the renewable fuel/diesel market. There are many factors to consider primarily focused on the issues and challenges in optimizing inbound feedstocks and outbound finished product to the growing low carbon fuel (LCFS) markets. As U.S. refiners are making significant investments to capitalize on this growing market and their ability to secure funding to build additional capacity, here are some key strategic decisions critical to their success.

- Network sourcing and supply chain strategy:

Feedstocks, including biomass, soybean oil, distiller’s corn oil (DCO), animal fats, and used cooking oil (UCO) - Railcar fleet sizing, specifications, and sourcing:

For both feedstocks and finished product - Multi-modal transloading, storage, and distribution strategy and implementation

“According to Graham Brisben, CEO of PLG Consulting, “The feedstock supply chain for renewable diesel is rail-centric, creating new tank car volumes from a myriad of sources and suppliers. This represents both an opportunity for railroads but a complexity for renewable diesel plants and producers. Suppliers who already have tank cars and existing rail contracts are well suited to provide feedstock on a delivered basis, but this means that the renewable diesel plant sites will need to have the ability to manage and store multiple pools of railcars.” - Logistics assessments and optimization for new plant sites:

Including rail access, plant site infrastructure design and engineering, and inventory and storage requirements. In some cases, both barge and vessel marine access will be critical as well.

“Plant site logistics infrastructure must be configured correctly for not just volumes but also operational efficiency and optimal commercial agreements with serving carriers,” says Brisben.

Many refiners and producers are partnering with supply chain and logistics experts to ensure their strategy enables efficiency and cost competitiveness as a key aspect of enabling market adoption.

Potential renewable diesel opportunity for rail expected to average ~$300 million annually

Combining inbound and outbound opportunities, PLG Consulting estimates each 100 MM gallons per year of RD refining could represent ~7,000 incremental carloads, with geography, vessel, and pipeline alternatives favoring the Western railroads. While market share and pricing leave open a wide range of outcomes, early indications are that this could be a $100M to $500M annual market for railroads to carry energy products. This would represent a solid incremental opportunity for the Western carriers, whose combined revenues were ~$48B in 2019.

Turner, Mason & Company has been active in the renewable diesel market for the past 10 years through single and multi-client engagements including due diligence of renewable diesel facilities. In response to growing market interest, our team is currently engaging with clients on renewable diesel market opportunities created by the various blending mandates. We are analyzing future supply and demand of renewable diesel, quality and sustainability of feedstock supply, and the economics driving existing plant conversions and new builds. We have also worked cooperatively with PLG Consulting, combining their logistics expertise with our processing and market knowledge to provide comprehensive “one-stop shopping” assistance to clients where required. For more information about renewable diesel market analysis or any specific renewable fuels consulting engagements, please visit our website: www.turnermason.com and send us a note under ‘Contact’ or call Cinda Lohman or Sam Davis at 214-754-0898.