Published on

Thursday, September 28 2023

Authors :

Harold "Skip" York

“Prepare your minds for a new scale of scientific values.” – Dr. Morbius in Forbidden Planet

The August 31 blog on the hydrogen value chain laid the foundation that although there are many potential applications for hydrogen, the primary uses today are as a process feedstock in petroleum refining and chemicals. Though hydrogen as a fuel has been around for decades, there have been many roadblocks to its widespread adoption, including non-competitive cost, scarcity of inputs, lack of distribution infrastructure, storage durability and efficiency, and safety concerns.

However, as the drive towards decarbonization gains traction, hydrogen is becoming a widely discussed topic in the Energy Transition. Various international organizations, such as the UN and IEA, propose hydrogen plays a fundamental part in achieving net zero emissions. For perspective, the IEA’s Net-zero scenario is one of the more optimistic on the role of hydrogen, making up ~13% of total final energy consumption.

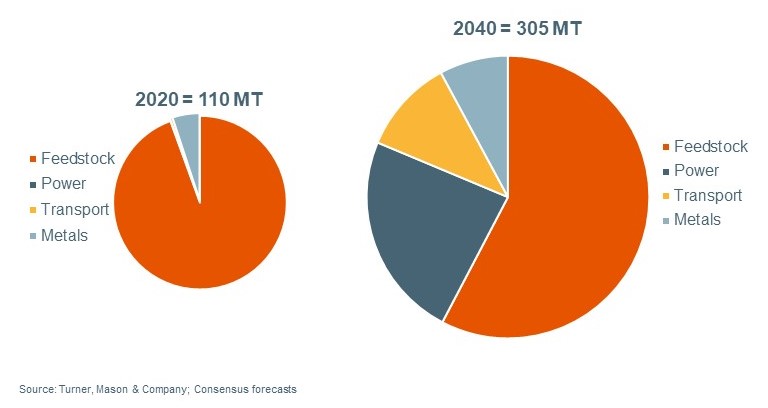

The current global market is ~110 MMTPA and most of this demand volume sits inside refineries and petrochemical plants, which have the internal, or adjacent, capacity to produce their requirements. The consensus view of a future hydrogen market can be seen in Figure 1. These forecasts estimate the global market could triple by 2040 (5.2% p.a.) to over 300 MMTPA.

Figure 1: Potential size of global hydrogen market by 2040

Many of the technologies and investments necessary to grow hydrogen demand beyond the current uses in petroleum and chemical processing will take a decade or longer to become material. To get an idea of which application might most value hydrogen, we spring forward to the 2040 market in Figure 1. Feedstock processing remains the largest segment, but power generation is the fastest growing sector, accounting for about one-third of global growth.

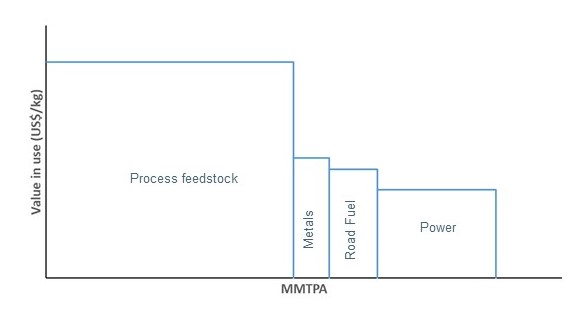

Based on U.S. market economics and assuming a carbon price of $200/tonne (the consensus value needed for a viable pathway to net-zero), we estimate the 2040 market could have a value of ~US$1,800 billion, about one-third the size of today’s global oil market. Hydrogen will not be a single global commodity as markets would be localized because transporting hydrogen over long distances would be quite expensive. Thus, while potential global volume growth could be very large, it would be the aggregation of numerous niche (but potentially high-margin) opportunities. The relative size and value of these opportunities are shown in Figure 2.

Figure 2: Hydrogen value-in-use for selected sectors in 2040

Source: Turner, Mason & Company Analysis

Source: Turner, Mason & Company Analysis

Value (US$/kg) will be greatest where hydrogen is used as a process feedstock (e.g., petroleum refining, chemicals, steel) in which it would be difficult to substitute away from hydrogen. When used as an alternative for energy transfer (e.g., road transport fuel, power), the value of hydrogen is diminished as the transformation of energy to hydrogen and then back to energy is an inefficient process (approximately 40% loss of energy content).

In our next blog we will examine how value might be distributed along the value chain within specific industries. In other words, do producers capture the same value for their hydrogen regardless of end-use application? Notice that so far, none of these analysis depends upon the “color”, e.g., carbon intensity, of any hydrogen production process. We are focusing on the size of the market and value of hydrogen in specific uses. We will introduce how much the carbon intensity of production might impact value in our fourth blog.

TM&C is actively consulting with clients seeking to evaluate hydrogen investment opportunities. For more information about areas we can assist you and your organization in hydrogen or any other areas of the energy landscape, please reach out to us at contact@turnermason.com or give us a call at 214-754-0898.

Source: Turner, Mason & Company Analysis

Source: Turner, Mason & Company Analysis