Published on

Tuesday, April 14 2020

Authors :

John Auers and Robert Auers

Last week, we began our series analyzing how the collapse in petroleum demand and subsequent required reductions in refining throughput will impact crude slates at U.S. refineries. In that blog, we discussed the fundamental factors which influence the types of crudes refiners purchase and the regional differences influencing those factors. These regional differences are significant and are based on both accessibility and refinery configuration, which themselves are interrelated. We started the series last week by focusing on the two inland regions, PADD 2 and PADD 4. In these regions, which do not have access to waterborne crude, the options on how to adjust crude slates is pretty limited and often related to decisions made by regional producers on which crude grades will be “shut in.” Today’s blog looks at the other extreme; PADD 3, whose coastal refineries (which make up the large majority of the regions facilities) have access to not only a wide range of Canadian and domestic crudes, but also can choose from waterborne grades from around the world. The decisions these refiners make in regards to crude purchase can be quite complex even in normal times. They have shifted significantly over the last decade as a result of changes in both product markets and crude production. With the massive crude throughput reductions which are required in the current environment, along with the extremely uncertain crude supply situation and resulting volatility in grade differentials, more shifts are coming in the short term. We will discuss all of these dynamics in today’s blog.

Changing Product Demand

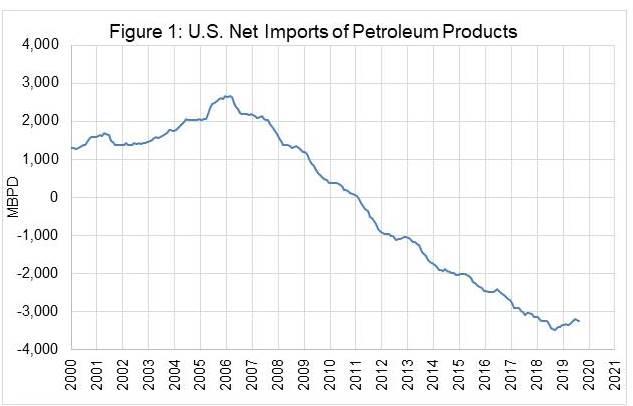

PADD 3 has always been the “big dog” in terms of U.S. refining, responsible not only for supplying local demand, but also much of the demand in PADDs 1, 2, 4, and even a portion of PADD 5 demand, primarily in Arizona. More recently, PADD 3 has also become the major driver of U.S. refined product exports, with the majority of these exports headed to Latin America. Just a decade ago, the U.S. was the world’s largest importer of refined products, and net imports exceeded 2 MMBPD as recently as the mid-2000s. The refined product balance has reversed dramatically and the U.S. is now the world’s largest net exporter of products, and net exports have averaged over 3 MMBPD since 2017. This transition from importer to exporter has been the result of three major driving forces – decreasing U.S. refined product demand, increasing U.S. refinery utilization (partially driven by the availability of cheap North American crude and natural gas), and poor Latin American refinery utilization. Figure 1 shows total U.S. net imports of petroleum products since 2000. Note the sharp reversal in the trend beginning in 2006.

Shifting Crude Supply Environment

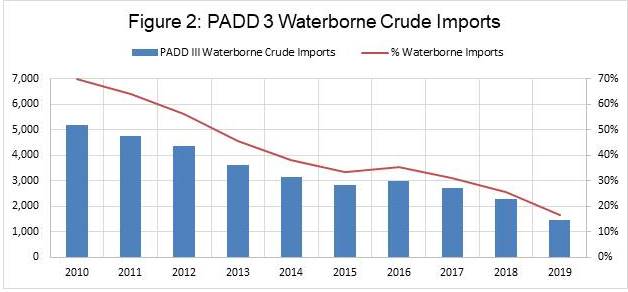

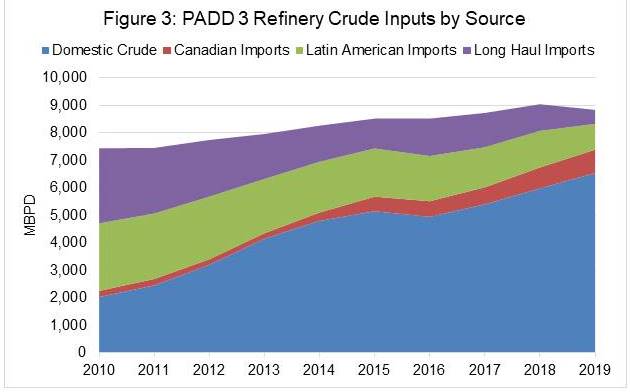

At the same time that product markets were changing, PADD 3 has also experienced a dramatic shift in the crude supply picture. Both upstream and midstream developments resulted in the replacement of significant volumes of waterborne crude imports with a combination of Domestic and Canadian barrels, with waterborne crude imports falling from 70% of PADD 3 crude runs in 2010 to just 16% in 2019. This data is shown in Figures 2 and 3.

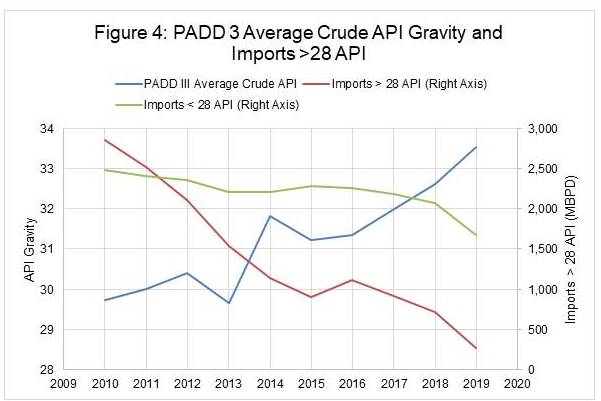

While the new Canadian barrels moving to the United States Gulf Coast (USGC) have been heavy, the U.S. production has been essentially all light tight oil (LTO). As a result, light and medium crude imports were the first to be displaced, while waterborne heavy crude imports (primarily from Venezuela and Mexico) have declined to be replaced by barrels sourced from the growing volumes coming out of the Western Canadian oil sands region. More recently (over the last couple of years), the Canadian imports have hit takeaway limits and together with an acceleration in the decline of Venezuelan supply (which fell to zero due to the sanctions enacted in the Spring of 2019), this has resulted in a substantive decline in total heavy crude imports into PADD 3 and a significant narrowing of the light-heavy differential. Combined with the continued growth in LTO production, PADD 3 refinery crude slates have continued to lighten, with the 2019 average API exceeding 33.5, their highest level since 1986. This data is shown in Figure 4.

Future PADD 3 Crude Slates

As noted above, the trends in USGC refinery crude slates have all been driven by changing supply dynamics: the growing volumes and increasing availability of cost-advantaged U.S. and Canadian production and shrinking or stagnant availability of foreign crudes, especially Latin American heavies and West/North African light crudes. In the same way, the future crude slates of PADD 3 refineries will be heavily dependent on the future availability and pricing of different crude grades. We’ll look at two time frames here: 1) the very short term (then next two to three plus months), where refiners are having to make drastic cuts in response to the “demand cliff” caused by COVID-19 lockdown effects, and 2) the short to medium term (out to 2022), as demand returns when the lockdowns are relaxed, but the market is still impacted by the effects of continued low prices and the production trends that result.

In the very short term, refiners are scrambling to make significant crude throughput cuts in response to the drastic fall off in product demand. As we discussed in last week’s blog, both the absolute level of the cuts and types of crude which will be reduced will be very refinery specific and related to a variety of factors as each refinery attempts to optimize refinery operations and economics. These factors include contractual obligations, storage capabilities, access to crude supply and product markets, refinery configuration, turndown capabilities, and a variety of others, all of which vary from refinery to refinery. Certainly, refiners will attempt to construct a crude slate which maximizes distillate vs. gasoline production as the demand for those products diverge, which means that the gasoline-heavy LTO crudes will preferentially be reduced compared to more distillate friendly West African light crude and heavier crudes from a variety of regions. Many refiners have long-term contractual obligations for certain grades and these crudes will be somewhat insulated from reductions. This includes heavy Mexican barrels, so we can expect that Maya will be substantially retained in crude slates and with Mexico limiting cuts in the recently announced OPEC+ agreement, this dynamic should continue over the next few months. Saudi crudes, which are very attractive this month due to the sharp cut in prices and increase in supply, will be less available when the reductions begin in May. Overall, we can expect very volatile crude differentials over the lockdown period as refiners make these tough crude slate decisions.

Once we get past the “hard” lockdowns and economic activity begins to return along with petroleum demand, a variety of dynamics will influence crude slate compositions in PADD 3. With U.S. production set to decline over the next one – two years, we can expect the economic incentive to run LTO to shrink. However, most of the decrease in domestic production will come in the form of decreased crude exports, meaning that PADD 3 inputs of domestic crude oil are unlikely to decline in line with (or close to in line with) domestic production. Canadian production, while also declining in response to the lower prices, will likely do so at a slower pace than LTO, due to the nature of the production itself. However, medium-term production growth will be well below levels that were anticipated before the current crisis as investment in new projects dry up. These domestic and Canadian barrels will be replaced with the most economic options and waterborne imports could increase, but this will also depend on the actual level of production from those foreign sources, which in turn will depend how the OPEC+ group manages and complies with this weekend’s agreement. We expect a situation similar to, but potentially more pronounced than, 2015-2016 to play out, when Middle East crude imports to the USGC increased from 956 MBPD in 2015 to 1,165 MBPD in 2016. By 2022, however, we expect U.S. production to resume its growth trajectory with PADD 3 domestic crude runs also coming back. We also expect Canadian production growth to resume, although a steeper growth trajectory won’t take place until the second half of the 2020s, as the longer investment cycle there means that production growth will take more time to respond to price signals. Pipeline developments (especially in regards to the TransMountain expansion and Keystone XL) will also play a major part in Canadian supply dynamics to the USGC. The potential return of Venezuelan crude is certainly a major wild card for PADD 3 refiners, but doesn’t appear to be a likely for some time, while developments in Mexico and their impacts on Maya production will also be an important factor to USGC deep conversion refineries.

The shifts in global crude supply dynamics will provide both tailwinds and headwinds to PADD 3 refiners, with the relative magnitude of these headwinds and tailwinds varying by individual refinery. Inland PADD 3 refiners, whose economics are more in line with PADD 2 and 4 refiners, will be more challenged, as their crude cost advantages shrink. For the coastal refiners (which account for the large majority of PADD 3 refining capacity) effects will be more variable. Those who process primarily domestically-produced light crude, will be directionally disadvantaged, as their relative feedstock costs increase. Those processing higher volumes of heavy crudes, however, might see more favorable economics if (as we expect) global light-heavy differentials increase. When incremental Middle-Eastern production returns, it will be medium and heavy sour crude, and will be primarily replacing light sweet crude from the U.S. This, combined with the effects of the new IMO bunker fuel sulfur regulations, will drive light crude prices higher (on a relative basis) and medium and heavy sour crude prices lower.

In this rapidly changing and very uncertain environment, Turner, Mason & Company will be following developments related both to the COVID-19 pandemic and responses and OPEC+ actions very closely. We will be analyzing how those developments impact crude prices, differentials, product demand, crude production, refinery utilizations and ultimately industry margins and prospects. Some high-level aspects of these analyses will continue to be presented and discussed in this blog over the next few weeks and months. We will be incorporating the analysis in a detailed and comprehensive way in the next edition of our C&RPO, scheduled to be issued in the summer. As always, the C&RPO will include a detailed forecast of both crude and refined product prices, product demand, refinery capacity changes, and a variety of other key industry parameters. For more details about this publication or other TM&C services, please visit our website or give us a call.