Published on

Wednesday, May 29 2024

Authors :

Sandeep Sayal

Options for reducing marine industry carbon footprint

The IMO (International Maritime Organization) 2020 sulfur regulation was a critical regulatory measure to reduce sulfur dioxide emissions from ships. It came into effect on January 1, 2020, with the regulation stipulating that the sulfur content in marine fuels used by ships should not exceed 0.50%, a substantial decrease from the previous limit of 3.50%. The oil and marine industries responded by modifying the specification of fuels used by ships, leading to a surge in demand for low-sulfur fuels such as marine gasoil and compliant, very low-sulfur fuel oils. Many ships also installed scrubbers as an alternate means to meet the sulfur limit requirement. The significant demand destruction from COVID-19 concealed much of the expected impact on the availability and pricing of compliant fuel during the implementation period, giving additional time for the marine industry to comply. The proactive approach and preparation by all the stakeholders ensured a remarkably smooth transition to the new rules, so fears of price spikes failed to materialize. This blog will discuss various possibilities that shipping companies are considering to reduce the carbon footprint of their fleet and operations. While these examples are not exhaustive, they demonstrate a growing trend of investments and initiatives in renewable energy motivated by environmental and regulatory factors.

Background

The marine industry is now focused on tackling carbon dioxide emissions, a significant contributor to climate change. The IMO member states adopted the 2023 IMO Strategy on Reduction of GHG Emissions from ships in July 2023. This strategy aligns with global efforts to reduce greenhouse gas emissions, such as the Paris Agreement. While ocean shipping’s share of global greenhouse emissions is relatively small compared to other transportation sectors, it is the primary mode of transport for global trade and accounts for the movement of most traded goods globally. Global trade is expected to continue increasing to support growing population needs and changing demand centers.

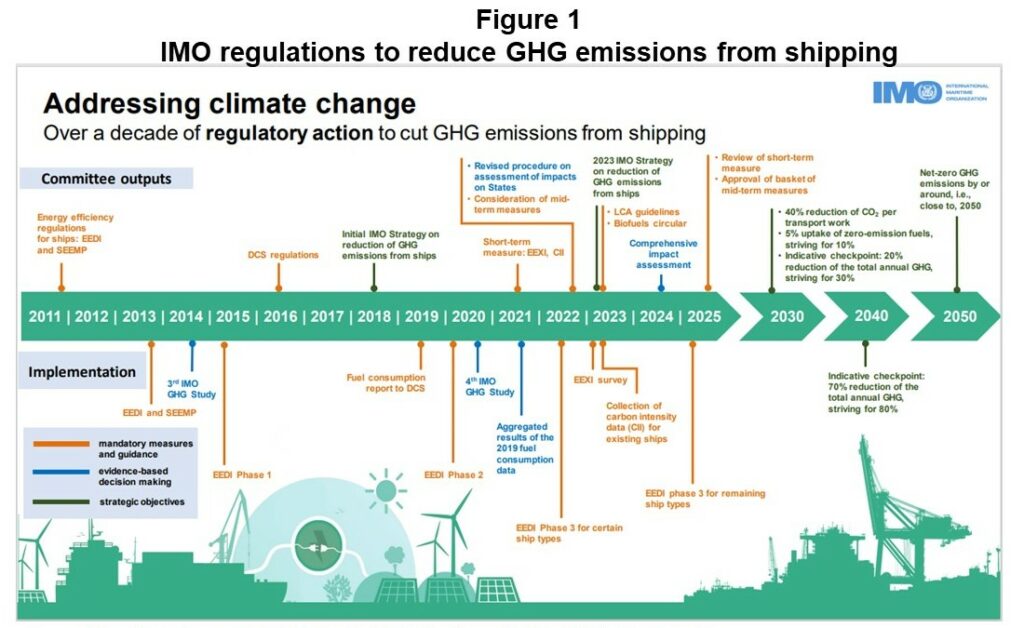

The 2023 IMO GHG Strategy has an ambitious goal to achieve net-zero GHG emissions from international shipping by 2050 and reduce carbon intensity by at least 40% by 2030. There is also a commitment to use 5% of alternative zero and near-zero GHG fuels in the total fuel mix, with a stretch goal of 10% by 2030. Figure 1 provides additional detail about the IMO GHG emissions reduction timeline.

Source: https://www.imo.org/en/MediaCentre/HotTopics/Pages/Cutting-GHG-emissions.aspx

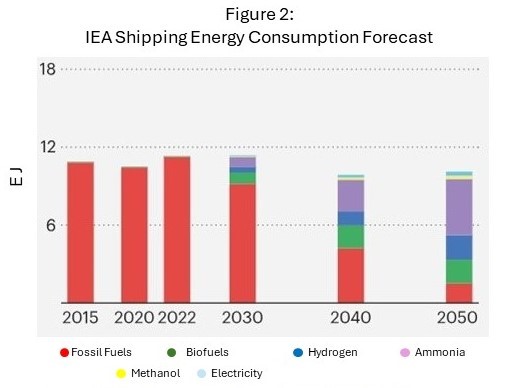

Shipping companies are increasingly investing in fuel-efficient technologies, assessing alternative fuels, and adopting measures to improve the energy efficiency of their fleets in line with IMO’s emissions reduction targets. The IEA also recently updated its Net Zero Roadmap, which describes the pathways to net zero by 2050, as illustrated in Figure 2. The forecast indicates that the penetration of alternative fuels will increase from a low level today to over 80% by 2050, significantly reducing the demand for traditional fossil fuels over this period.

Source: https://www.iea.org/reports/aviation-and-shipping

Technology & Alternative Fuel Options

LNG is not completely carbon-free but is a cleaner alternative to traditional marine fuels. Investments are being made to build new LNG vessels, bunkering infrastructure, and terminals. Even cruise lines are aiming to operate in a more environmentally friendly way. Some cruise lines are transitioning to alternatives from traditional marine fuel, with LNG as a preferred option. Carnival cruise lines have made major ship purchases fueled by LNG. Cruise lines are collaborating with cities and local utility companies to reduce emissions while docked in port by shutting down their primary engines and connecting to the local electricity grid.

Hydrogen shows potential as a zero-carbon fuel, as we observe increasing investments in hydrogen production technologies and hydrogen fuel cell systems for ships. CB&I, Shell, and DNV are working together to develop a large liquid hydrogen cargo containment system. This collaboration leverages CB&I’s proven technology for onshore storage of liquid hydrogen, Shell’s expertise in working with hydrogen carriers, and DNV’s safety and regulatory knowledge to create a strong framework for further development. Importantly, these design characteristics will support the transport of larger quantities of hydrogen compared to previous designs, decrease transportation costs, and potentially expand global hydrogen supply chains.

Significant research and investment have recently been made in infrastructure for Ammonia. If made from low-carbon hydrogen, it can be a renewable zero-carbon fuel. Companies are investing in building dual-fueled vessels that can run on LPG or conventional heavy fuel oil, with the option to use ammonia as a transport fuel. Despite higher upfront costs, these investments in dual-fueled vessels allow ship owners to pivot to an alternate fuel as regulations change. Mitsui O.S.K. Lines (MOL) has announced the delivery of a dual-fuel LPG and ammonia carrier, which can use LPG or conventional fuel oils, and transport LPG and ammonia. LPG can reduce CO2 emissions by about 20% and sulfur oxides and particulate matter by about 90% compared to heavy oils. The demand for ammonia, which emits no carbon dioxide during combustion, is expected to increase as a next-generation clean energy source. It could be preferred over hydrogen due to its higher energy density enabling a transportation advantage.

Methanol, especially green methanol, is considered a viable option as a diverse green fuel for the future. Maersk has signed a deal with OCI Global to deliver green bio-methanol for the first journey from Ulsan, South Korea, to Copenhagen, Denmark. This will provide Maersk with experience in handling methanol as a fuel as the company is expected to receive a fleet of new methanol-enabled ships in 2024.

Efforts are currently being made to invest in Carbon Capture and Storage technologies on ships, similar to investments being considered onshore. These technologies will help capture and store carbon dioxide emissions, thereby mitigating the environmental impact of traditional marine fuels. This will help provide the marine industry with time to transition to renewable alternatives. In a recent milestone, MOL has become the first Japanese operator to set up an onboard CO2 capture system on its product tanker that can recover up to 10% of CO2 from emissions, and the captured CO2 can be discharged ashore. This system, which is scheduled for completion at the end of 2024, also includes a scrubber function that removes 99% sulfur oxides and particulate matter from exhaust gases.

Blending Biofuels into marine diesel and fuel oil is also being explored as a viable alternative to reducing greenhouse gas emissions. Existing engines require no material modifications, as biodiesel can be blended as a drop-in fuel into bunker fuels. This suggests that ships can reduce their carbon footprint while retaining all transportation performance characteristics.

The maritime industry is making significant technological advancements, including developing larger, more efficient ships and exploring wind-assisted propulsion technologies such as sails and electric propulsion systems. As new vessels replace existing ones in the overall fleet, we will see an improvement in the operational efficiency of the marine supply chain.

The technologies currently being assessed and put into practice come with risks, high costs, and uncertainty surrounding regulations. It is necessary to define and implement mitigation strategies to ensure the safe and efficient storage, handling, and combustion of these alternative fuels before widespread adoption occurs. It is too early to predict which technology or pathway shipowners will choose for decarbonization. Given the magnitude and duration of ship capital decisions, companies should be seeking ‘no regret’ options they can adopt today that will put them on a cost-effective pathway that is sustainable over the long run.

Turner, Mason & Company continues to advise and consult with clients evaluating their decarbonization strategies and project economics in renewable diesel, SAF, RNG, hydrogen and ammonia. For more information about our services in these areas or any other consulting needs, please reach out to us at contact@turnermason.com or give us a call at 214-754-0898.