Published on

Tuesday, December 14 2021

Authors :

Robert Auers and John Auers

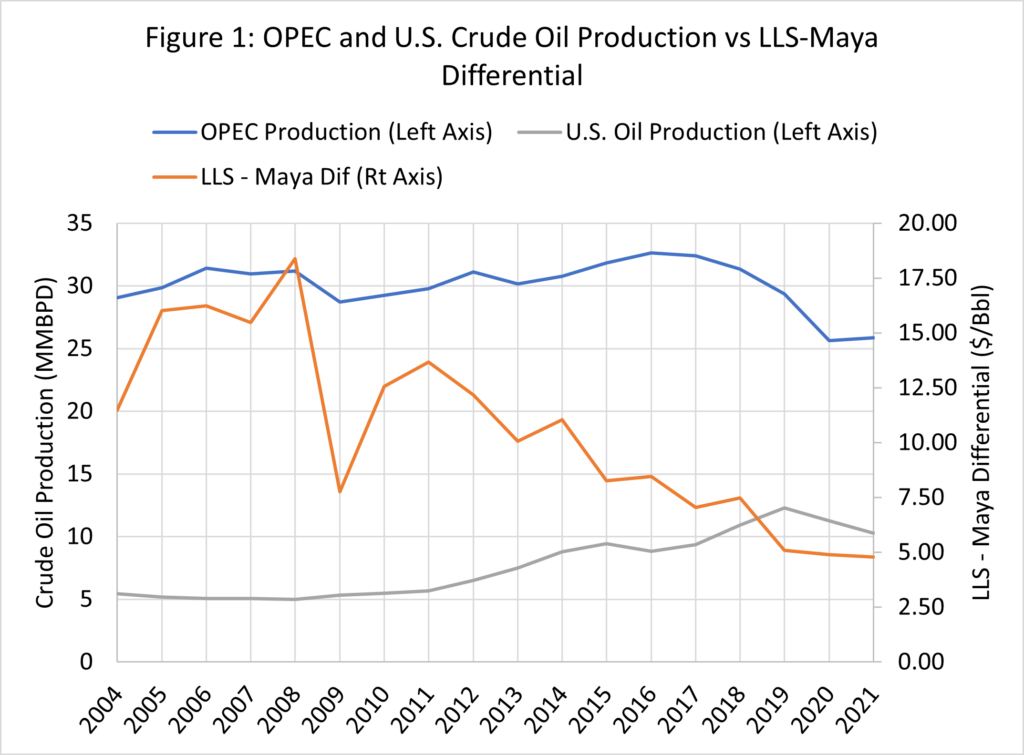

We’re pretty sure the Alt Rock group, Linkin Park, wasn’t thinking about crude quality supply/demand dynamics when they released “Heavy,” in 2017, but many U.S. refiners have had that topic on their mind for a number of years. In fact, those who invested significantly in the ability to efficiently process heavy crude in the 1990s and early 2000s would love to be able to ask the question in the title line of this blog which comes from that Linkin Park tune. When they made those investments, they expected heavy crude supply to be the predominant grade coming to market over the subsequent years and even decades. However, since 2008 the supply growth of light sweet crude has significantly outpaced that of heavy and medium sour crudes. This was first driven primarily by OPEC cuts during the Great Financial Crisis, which consisted primarily of medium sour grades, and then by the emergence of U.S. light tight oil (LTO) and the decline of Latin American heavy crude production (particularly in Mexico and Venezuela). These production trends led the LLS-Maya differential (the key indicator for heavy/light differentials) to decrease from over $18 per barrel in 2008 (and even higher levels for significant periods) to only about $5 per barrel in 2019. The new IMO rules requiring the use of 0.5% S bunker fuel were expected to widen the light-heavy differential in 2020 as the demand for high sulfur fuel oil was forecast to plummet. However, the emergence of the COVID-19 pandemic and resultant economic lockdowns had the opposite effect as global demand for all products crashed and OPEC+ cut production (primarily of heavier grades) by a record amount. This led the LLS-Maya differential to decline even further during 2020 and through the first half of 2021. These trends are shown in Figure 1.

*2021 data for January-October period

In the second half of 2021, the market saw some widening of the heavy-light spread as demand has recovered and OPEC+ has brought production back on line. This widening trend has ceased over the past few weeks with the emergence of new COVID restrictions in Europe and the spread of the new Omicron variant. Questions remain as to whether these will become just brief delays in the ongoing global demand recovery or major setbacks on our path back to “normal.” If it is the former (as we believe), the heavy-light differential will likely further widen in the near term as OPEC+ continues to bring production back on line and demand recovers. In a worst-case scenario, we could see COVID-19 restrictions lingering for years to come if countries continue to respond to seasonal COVID-19 waves with new restrictions. This sort of outcome could keep demand depressed and lead OPEC+ to pause their production increase, with both putting downward pressure on the light-heavy differential. Over the longer term, however, the supply dynamics of light and heavy crude will depend more on the trajectory of U.S. (and international) shale oil production, OPEC+ policy, the recovery of (or lack thereof) Latin American production, and the trajectory of heavy Western Canadian production.

On the light crude side, U.S. crude production growth has already resumed, but at a slower pace than that seen before the beginning of the COVID-19 pandemic. And, despite high crude prices, publicly-traded operators, who produce the majority of U.S. crude oil, have been slow to increase drilling activity. Private operators, who are less subject to outside pressure, have rapidly increased spending and are now, in aggregate, operating more U.S. rigs than their publicly-traded peers. Publicly-traded operators will likely continue to add rigs next year as DUCs (drilled but uncompleted wells) have been drawn down, with the pace of that recovery being the major determinant of overall U.S. production growth over the next few years. Over the longer term, U.S. production will depend on geological constraints and pricing (which is, itself, a function of demand and supply growth in the rest of the world). Outside the U.S., shale/tight oil production is increasing rapidly in the Vaca Muerta play in Argentina’s Nequen province, with production there now around 200 MBPD. Russia also has large tight oil reserves, but has yet to see tight oil production commercialized. Gazprom Neft estimates that the Bazhenov formation in West Siberia could contain more oil than the Permian basin. Other shale basins that could eventually see commercial production exist in Mexico, Australia and the Middle East. Most nonshale light crude production remains in decline, with a few exceptions including that in Kazakhstan, Russia, and the Middle East. Still, light crude production growth in these regions will be relatively small and Middle East light crude production growth will be dwarfed by that of medium/heavy sour grades. Liza, which is a borderline light/medium (32 API), sweet (0.6% S) crude, production will also continue to grow. Most Brazilian pre-salt crudes (production of which will also grow) is of similar quality with Lula, for example, having an API gravity of 29 and a sulfur content of 0.4%.

On the medium/heavy sour side, most near term production growth will come from OPEC+. Over the longer term, OPEC production (especially in Saudi Arabia) will continue to grow, with that growth consisting primarily of medium and heavy sour crudes. Johan Sverdrup (28.5 API, 0.8% S) production is still growing as well and will help contribute to medium crude production growth in Europe over the next few years. In Latin America, Venezuelan production looks to have bottomed, but significant production growth in the country is unlikely under the current system. However, the country officially has the most crude oil reserves in the world and could grow heavy crude production substantially under better geopolitical circumstances, which could emerge in the next 2-10 years. Mexican production has stabilized over the past few years, but will likely return to decline in the next few years without large-scale foreign investment, which Lopez Obrador has mostly shunned. Finally, Western Canadian heavy production will continue to grow, but at a slower pace than that seen over the past 20 years.

The relative demand for light and heavy crudes will depend on the pace of refinery construction, scrubber demand installation, and overall product demand. The pace of new refinery construction announcements has slowed to a crawl as refiners have been hesitant to make large capital commitments given the uncertainty around COVID-19 restrictions and the energy transition. Scrubber installations have picked up slightly since the beginning of the year due to wider discounts for HSFO emerging, but remain well below the levels seen in late 2019 and early 2020. Near term global product demand remains uncertain given concern over the Omicron variant, but we still expect global demand to grow substantially in 2022 as COVID restrictions are removed.

Change in Relevant Benchmarks

In Figure 1, we used LLS – Maya as the relevant light-heavy differential. This differential has historically been the “benchmark” measurement for differential due to the importance of Maya as a coking crude feedstock for USGC refineries. However, as production of Maya has gone into long-term decline, it may no longer be the best heavy crude benchmark. New WCS pricing benchmarks have emerged on the Gulf Coast, and Castilla remains another viable alternative to Maya. LLS still remains perhaps the best benchmark on the light crude side, but WTI MEH provides an alternative Gulf Coast light crude benchmark in Houston with significant liquidity. None of this is to say that LLS-Maya differential should be ignored, but these other benchmarks should be monitored as well to gain a more complete picture of relative pricing dynamics for heavy and light crude oil at the USGC.

USGC Heavy Crude Supply Trends

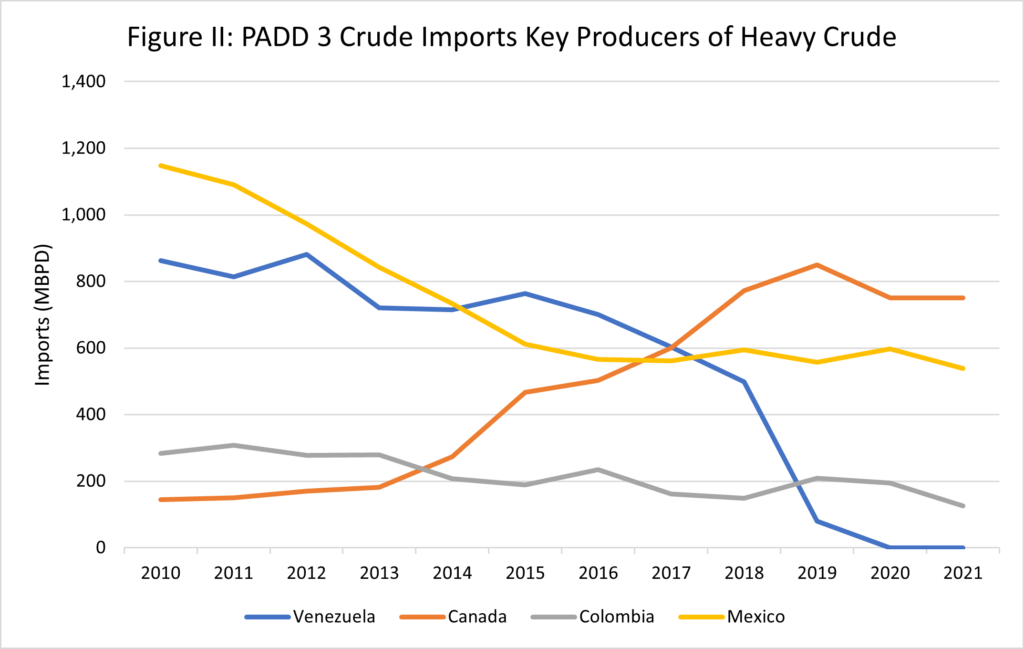

The USGC (PADD 3) is the largest and most important region for processing heavy crudes and should continue to retain that position for the foreseeable future, although Asia refining centers will become more important as new refinery construction in that region targets heavy crude processing capabilities. Figure II shows crude imports from the top three exporters of heavy crude to PADD 3 refineries – Canada, Mexico, and Colombia, along with Venezuela, who was, at one time, the largest supplier of heavy crude to PADD 3. We believe the actual amount of Canadian crude processed by USGC refiners is higher than that shown by the EIA, as some Canadian crude is reported to be imported by PADD 2 terminals. This information becomes clearer when reviewing the company level import data published by the EIA. This higher value, estimated by TM&C, is the one displayed in Figure II. Going forward, imports of Canadian crude will generally continue to grow, though the completion of the Transmountain Expansion (TMEP) may cause a shift in Canadian crude moving from PADD 3 to PADD 5 and Asia. Still, continual growth of Canadian production will bring more Canadian crude to PADD 3 over the longer term. Meanwhile, declining or stagnant crude oil production in Colombia and Mexico means that imports from those countries are likely to, at best, remain flat, or, more likely, decline further. A removal of Venezuelan sanctions could bring a small volume of Venezuelan crude back to PADD 3 in the short term, but a return of Venezuelan imports on a larger scale would require a resolution of at least some of the major above-ground issues in the country and is a much longer term prospect.

TM&C Heavy Crude Outlook

This blog, by necessity, only provides a brief overview of our thoughts regarding crude quality market dynamics. In a report we issued in early 2021 we provided a detailed analysis and forecast of the supply/demand balance for heavy, medium, and light crude through 2040. We will be publishing an updated version of this report in February 2022. In this report, crude supply/demand changes by grade will be analyzed and measured against the current environment to reflect the relative grade dynamics over the forecast period. Included in the report will be the following data:

- Crude Production Forecast by Grade to 2040– including regional breakdowns;

- Annual Refinery Capacity Changes– including changes in quality processing capabilities;

- Crude Supply/Demand Balance by Grade;

- Forecast of Crude Price Differential; and

- Key Sensitivities to Base Case Forecast.

Along with the data tables will be a qualitative assessment of the key factors impacting the supply/demand forecasts, along with the analysis of key sensitivities and scenarios different than our Base Case forecasts. For more information about the upcoming heavy crude outlook report or for any consulting needs around this topic or any others, please reach out to us at contact@turnermason.com or give us a call at 214.754.0898