Author: Elizabeth Hilbourn

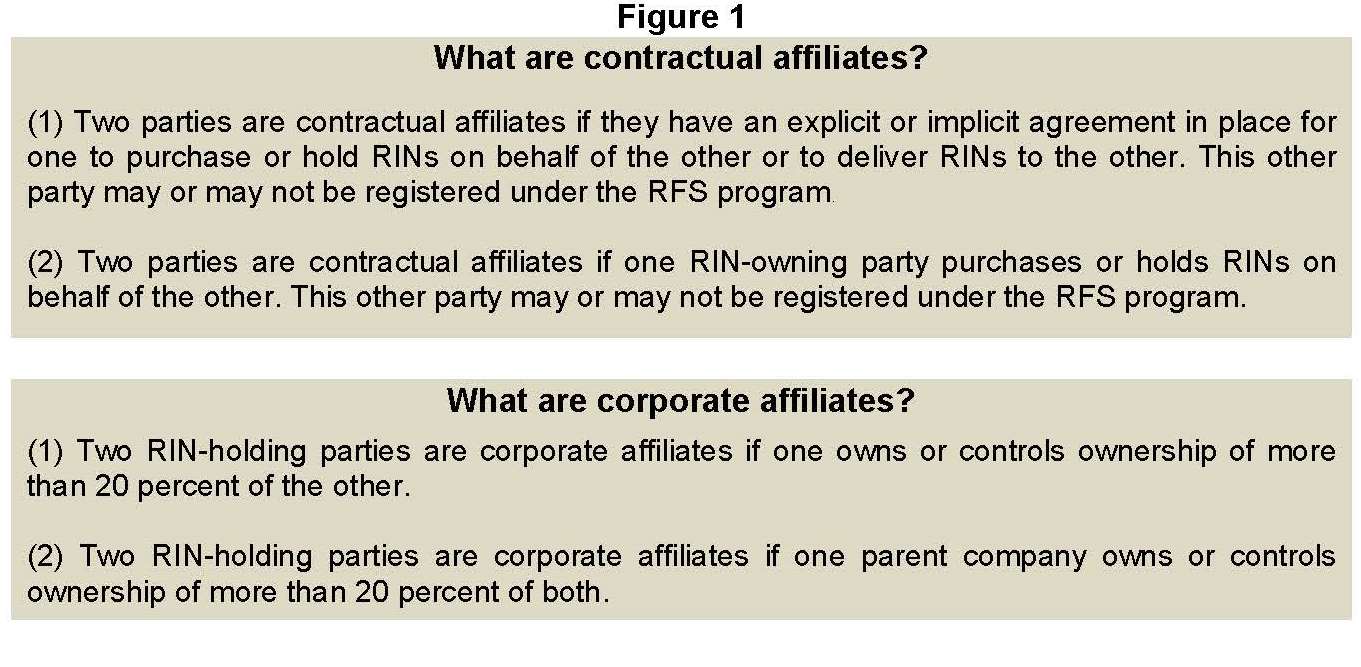

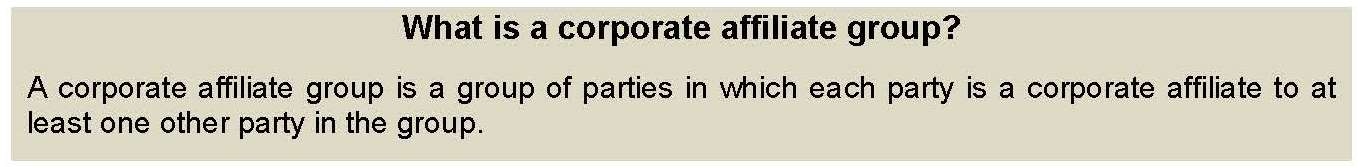

On June 10, 2019, RIN holding calculations were written into subpart M of the renewable fuel regulations. The EPA made these regulatory changes in order to prevent market manipulation. Though they have yet to see data-based evidence of such behavior, they believe that the potential for manipulation is a concern. These calculations are required to be performed daily amongst contractual and corporate affiliates starting January 1, 2020. With end of day separated D6 holdings, primary and secondary thresholds are calculated. Companies are required to report quarterly if thresholds have been exceeded in any day of the quarter. If thresholds have been exceeded, the EPA may publish the name and EPA-issued company identification number of the submitting company. Based on EPA’s glimpse of 2018 RIN data, no companies are anticipated to have exceedances, so this is anticipated to solely boil down to a recordkeeping exercise.

Primary RIN Threshold Test

The primary RIN threshold test compares daily separated D6 RINs to the expected annual volume of conventional renewable fuels for the compliance period which is generally 15 billion gallons. If any day exceeds 3%, the primary data threshold has been exceeded. Only the names of non-obligated parties, who have exceeded the primary RIN threshold will be published by the EPA (unless the secondary RIN threshold has also been exceeded). Obligated parties who exceed 3% are required to calculate the secondary RIN threshold test. Note that to exceed this threshold a corporate affiliate group would have to hold 450 million k=2 D6 RINs in one day. This is quite unlikely unless you are a large obligated party.

Secondary RIN Threshold Test

The secondary RIN threshold test incorporates the prior year implied conventional renewable volume obligation (RVO) which, in most cases, is the prior year D6 RVO minus the D5 RVO. Said another way, it is the amount of D6 RINs which were required to be retired to meet the prior year obligation. The secondary RIN threshold has been exceeded if it exceeds 130% for any calendar day.

For both primary and secondary thresholds, an extra 25% is allowed for the first quarter of the year since prior year compliance is not due until the end of the quarter.

How to Keep the Recordkeeping Exercise Simple

TM&C suggests performing this recordkeeping exercise quarterly by doing the following:

- At the end of each quarter, each company calculates daily separated D6 holdings;

- Quarterly, each company of the contractual or corporate affiliate sends to the designated affiliate:

- The quarter’s worth of daily separated D6 holdings and

- If the company is an obligated party, their prior year implied conventional renewable volume obligation (RVO).

- The designated affiliate performs the primary and secondary threshold calculations and sends to each contractual or corporate affiliate; and

- Each contractual or corporate affiliate shares filed EPA reports which will be required the following year for attestations.

How to Calculate Quarterly Daily Separated D6 Holdings

- Subscribe to the following EMTS Reports:

- Monthly Transaction History– used to calculate daily k=2 D6 holdings based on a starting point

- Monthly RIN Holdings– used to check k=2 D6 holdings for points in time and can act as a starting point

- Transaction History (weekly)- support but not necessary

- RIN Holdings (daily)- support but not necessary

- Calculated daily k=2 D6 holdings from Monthly RIN Holdings

- Check daily k=2 D6 holdings from a starting point and each day’s (k=2 D6) buys, sells and separations.

TM&C has developed a program to perform this calculation and is available upon request.

Which Subpart M Regulations are involved?

- Reporting: §80.1451(c)(2)(ii)

- Recordkeeping: §80.1454(u) Requirements for recordkeeping of RIN holdings for all parties transacting or owning RINs and §80.145 (v) Requirements for recordkeeping of contractual and corporate affiliates

- Attestation: §80.1464 (a)(4) [Obligated parties and exporters] or §80.1464 (b)(5) [Renewable fuel producers and RIN-generating importers] or §80.1464 (c)(3) [Other parties owning RINs]

TM&C has a wealth of experience spanning several decades in virtually all of the clean fuel programs affecting refiners and marketers. Throughout its history, TM&C has provided consultation on EPA and state fuel programs in essentially all aspects of compliance. TM&C is in the process of becoming an accredited verification body with the California LCFS program. If you have any questions regarding regulatory issues or are in need of a verification body, please contact Beth Hilbourn or Cinda Lohmann at (214) 754-0898. Our next Focus on Fuels article will cover California LCFS validation and verification.