Going into the holiday season of 2021 was not a typical time for the industry. With three key regulatory proposals released by the Agency in late November / early December, our Fuels Regulatory practice has been diligently working to answer questions for our clients and to support the public comment periods which close in early February. This edition of “Focus on Fuels” will take a deeper look at the Notice of Proposed Rulemaking (NPRM) for the RFS Annual Compliance Volume Standards rule and the impact which the proposal may have on the industry.

A look at the 2020 and 2021 proposed volume standards

In the NPRM, the Agency proposed to revise the volumes for 2020 to actuals. In addition, the 2021 volumes are proposed at projected actuals by year’s end. For 2022, the Agency’s intent was to propose volumes which would get the RFS program back on track with historical growth projections yet not facilitate a draw down in 2022 carryforward RINs from the bank. In addition, half of the court-ordered remand from 2016 would be incorporated in 2022.

For 2020, the Agency is proposing to use their reset authority and adjust the volumes to actual fuel consumption levels. For 2021, the same intent was stated – to establish the renewable volume obligation equal to the volume of RINs generated from both domestic and foreign renewable fuel production with renewable diesel and advanced biofuel expected to increase significantly throughout 2021 and ethanol consumption increasing toward 13.8B gallons. Although the details for 2020 and 2021 were not outlined, the calculations can be performed from both the EIA and the EPA public databases. TM&C analyzed both the proposed adjusted 2020 and the proposed 2021 renewable volume standards to understand the impacts on the carryforward RIN volumes out of a compliance year.

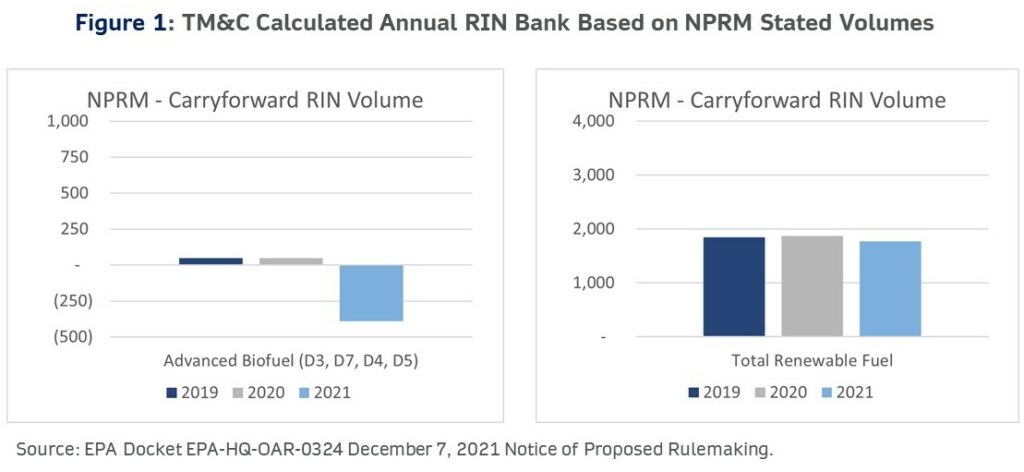

Although it is uncertain (i.e., not specified) what data set was used by EPA for projecting the volume of RINs generated in 2021, the actual RINs generated and available for compliance through October 2021 does not appear as large as the volume of RINs projected by the Agency. The actual RIN volume accounts for the foreign production of renewable fuel imported as well as the retirement of RINs for renewable fuel exports. Based on the model calculations, the actual volume of cellulosic biofuel produced resulted in a volume of RINs less than the obligation proposed by 128M gallons. Therefore, obligated parties, as a whole, will be expected to purchase cellulosic waiver credits for 2021 to satisfy part of the proposed obligation. This is also observed in the advanced biofuel (AB) category where the volume of available AB RINs is less than the obligation by 436M gallons. Due to the nesting of RIN obligations, obligated parties can purchase additional biomass-based diesel RINs to satisfy the AB category; however, even with the carryforward of prior year RINs (2020 carryforward RINs), there will not be adequate AB RINs to cover the obligation. The total deficit of AB RINs is calculated to be 388M gallons. This shortfall in the AB category is masked by the total renewable fuel 2021 carryforward RIN volume remaining essentially flat at 1.87B gallons as intended by the Agency.

In the NPRM, the Agency does comment that the proposed volumes for 2021 will be actualized before the rule is finalized. Should the Agency uphold this commitment, the volume standards for both cellulosic and advanced biofuel are expected to decrease to align with actual renewable fuel production volumes. This actualization will be critical to upholding the integrity of the program and to meet the primary objective of the Energy Independence and Security Act of 2007, to move the United States toward greater energy independence and security.